To this end, the WHO FCTC requires Parties to establish or

reinforce and finance a national coordinating mechanism or focal

point to develop, implement, periodically update, and review

comprehensive multi-sectoral national tobacco control strategies,

plans, and programmes (Articles 5.1 and 5.2).

Generally many countries still lack the necessary structural,

human, financial, and technical resources to implement

cost-effective and sustainable tobacco control programmes.

Few national governments in ASEAN have a sufficient number of

staff working full-time on tobacco control.

Both Singapore and Thailand have strong tobacco control policies

in place with support from a significant number of national-level

tobacco control staff, while other countries in the region need to

build national capacity (human, financial, and technical) to carry

out effective and sustainable tobacco control programmes to combat

the tobacco epidemic.

| Country | National mechanism for tobacco control | Governmental funding mechanisms for tobacco control |

|---|---|---|

| Brunei |

National Committee for Tobacco Control Multi-sectoral Taskforce for Health |

Yes |

| Cambodia | Committee for Tobacco Control (CFTC) | No |

| Indonesia | None, only Ministry of Health (MOH) Focal Point* | Yes** |

| Lao PDR | National Tobacco Control Committee | Yes |

| Malaysia | Framework Convention on Tobacco Control (FCTC) Secretariat | Yes |

| Myanmar | Central Board of the Control of Smoking and Consumption of Tobacco Products | No |

| Philippines | Department of Health (Health Promotion Bureau, Disease Prevention and Control Bureau, and Bureau of International Health Cooperation) and the Food and Drug Administration | Yes |

| Singapore | Health Promotion Board | Yes |

| Thailand | National Tobacco Products Control Committee | Yes |

| Vietnam | Vietnam Tobacco Control Fund (VNTCF) | Yes |

*Tobacco-Related Disease Control unit, Directorate of Non-communicable Diseases (NCDs), Ministry of Health.

**Local Government mechanism through Local Tobacco Tax and Excise Sharing Fund.

Article 6 Guidelines recommend countries “dedicate revenue” to

fund tobacco control and other health promotion activities.

Article 26 requires all Parties to secure and provide financial

support for the implementation of various tobacco control programs

and activities to meet the objectives of the convention.

Tobacco control and health budgets in ASEAN

The global tobacco control funding gap is currently estimated at USD 27.4 billion. The current average annual amount of domestic funding for tobacco control per country is USD 15 million, half of what’s needed to scale-up FCTC policies implementation.

The Way Forward: Innovative National Financing Solutions

In many countries tobacco control is often not a national priority.

Consequently, domestic resources for WHO FCTC implementation are far

from secure and must compete with other programmes for government

funding. An effective way to address this is the introduction of

dedicated surcharge taxes on tobacco and alcohol, which can aid in

reducing consumption of these harmful products and, more

importantly, provide a more secure funding stream for health

promotion and tobacco control programmes.

Four out of ten ASEAN countries have established health promotion or

tobacco control funds through surcharged taxes (Thailand, Lao PDR

and Vietnam) and treasury budget (Singapore).

Governance and roles of health promotion/tobacco control funds in ASEAN

| Type and Year Established | Type | Governed and chaired by | Report to | Role of organization | |||

|---|---|---|---|---|---|---|---|

| Granting agency | Policy development | Implementing health promotion programmes | Building capacity | ||||

| Thai Health Promotion Foundation (ThaiHealth) (2001) | Autonomous agency | Board of Governors and chaired by Prime Minister | Cabinet and to both houses of Parliament | ✓ | ✓ | ✓ | ✓ |

| Singapore Health Promotion Board (2001) | Statutory Board under MOH | Board of Directors and chaired by independent Chairman | Minister of Health and Parliament | ✓ | ✓ | ✓ | |

| Vietnam Tobacco Control Fund (2013) | Semi-autonomous agency and a unit in MOH | Inter-sectoral Management Board chaired by Minister of Health | Government Office and National Assembly | ✓ | ✓ | ||

| Lao PDR Tobacco Control Fund (2013) | Unit in MOH | Tobacco Control Fund Council (National Tobacco Control Committee chaired by Director General of Finance and Planning Department, Ministry of Health) | National Tobacco Control Committee and Government Cabinet | ✓ | ✓ | ||

Health promotion fund resource hub

The Southeast Asia Tobacco Control Alliance (SEATCA) and the Thai

Health Promotion Foundation (ThaiHealth), established an online of

Health Promotion Fund Resource Hub and Health Promotion Fund

E-learning course.

The HPF Hub (hpfhub.info) serves as one-stop resource for

innovative sustainable financing mechanisms for health promotion.

The HPF Hub provides a comprehensive guide to understand the

importance of a health promotion fund, fiscal mechanisms to secure

a long-term sustainable fund, fund management, and practical steps

to establishing a Health Promotion Fund alongside evaluation and

assessment frameworks.

In addition, the HPF Hub offers a free e-learning course on

“Innovative and Sustainable Financing for Health Promotion and

Tobacco Control”.

Recognizing most countries are still facing inadequate and

sustainable funding to address health and economic burdens caused

by NCD, this e-learning provides an online learning platform for

sharing knowledge and lessons learned from experts on developing

innovative financing mechanisms to secure sustainable funding for

health promotion and NCD prevention.

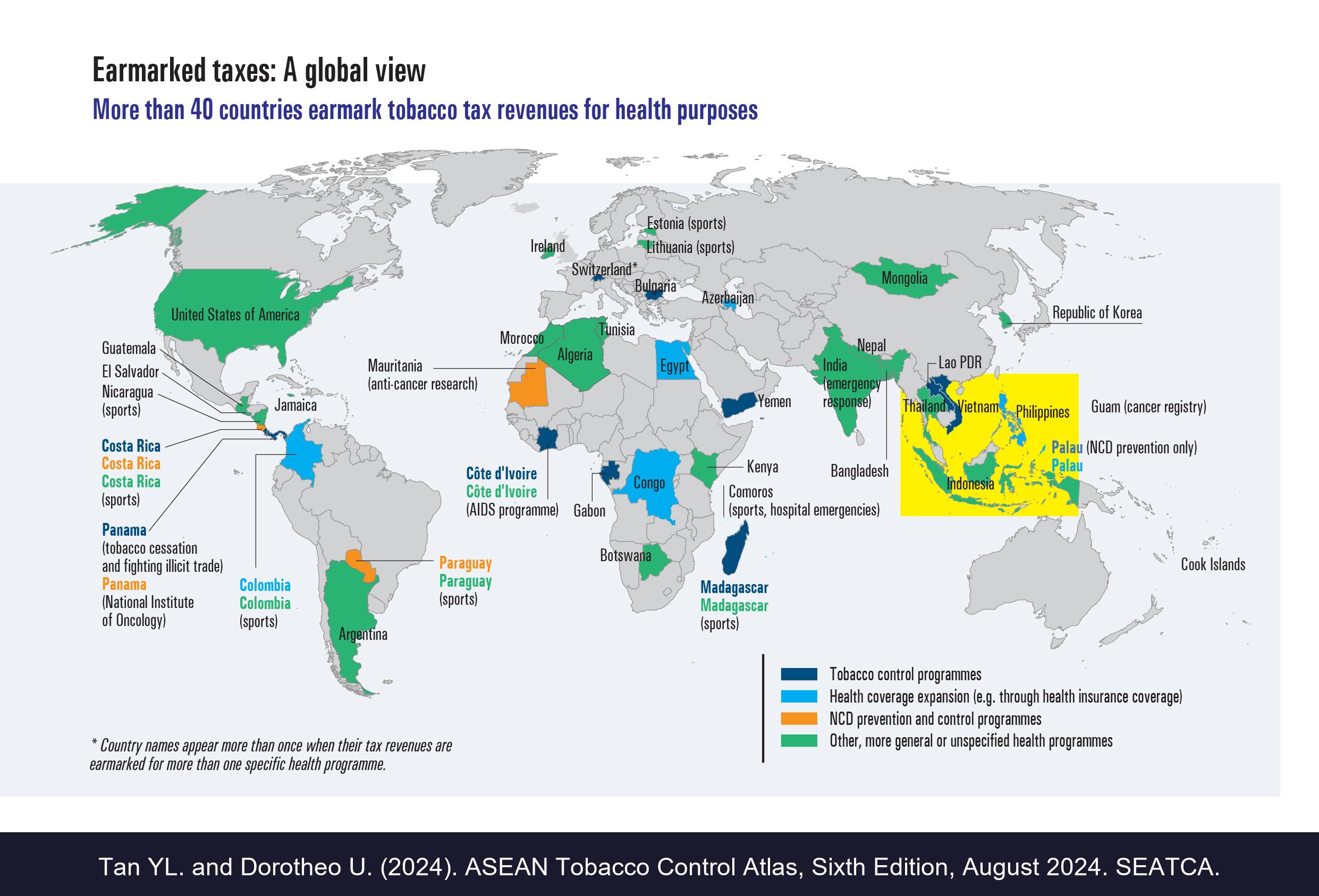

Earmarked taxes: A global view

More than 40 countries earmark tobacco tax revenues for health purposes

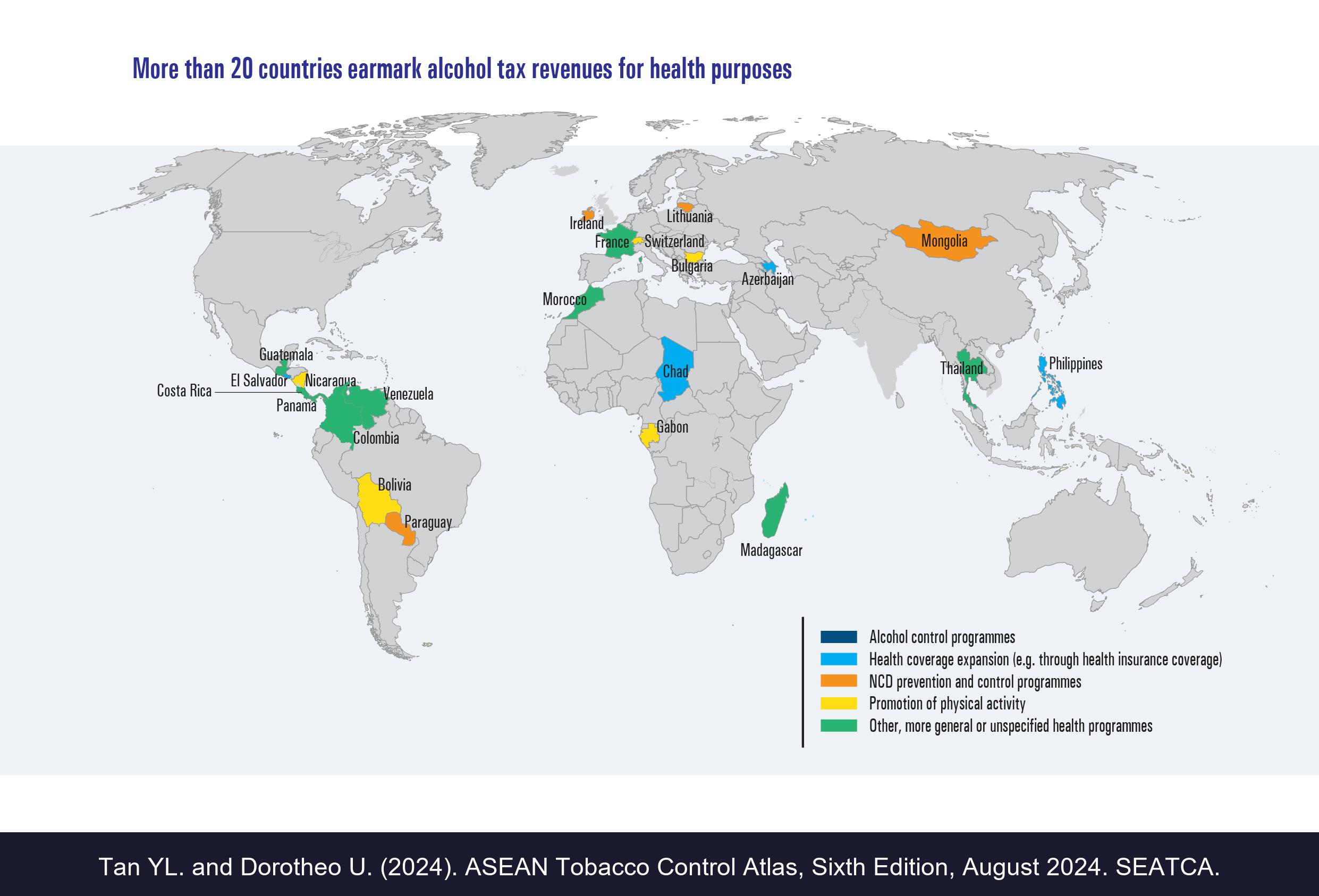

More than 20 countries earmark alcohol tax revenues for health purposes

Funding for tobacco control is low - received only

0.3% of total development assistance

for health (DAH) between 2018 and 2021.

An annual funding of

USD 9.6 billion is needed for

comprehensive implementation of WHO FCTC worldwide. However, the

current funding available for tobacco control programmes is about

USD 1.2 billion (equivalent of

12% of the amount required for

comprehensive tobacco control implementation) with an annual

funding gap of USD 8.4 billion.

Innovative funding mechanisms in ASEAN

| Budget Allocations (USD) | |||||

|---|---|---|---|---|---|

| Ministry of Health Budget | Health Promotion Centre (operational budget), Ministry of Health, Brunei (2008)* |

408,606 (BND 550,000) (2023-2024) 408,606 (BND 550,000) (2022-2023) 185,730 (BND 250,000) (2021-2022) |

189,107 (BND 250,000) (2019-2020) 115,942 (BND 160,000) (2017-2018) 115,942 (BND 160,000) (2016-2017) |

||

| Singapore Health Promotion Board (2001)** |

435 million (SGD 591 million) (2022) 358 million (SGD 486 million) (2021) 241 million (SGD 328 million) (2020) |

261.71 million (SGD 352 million) (2019) 185.61 million (SGD 245 million) (2018) 183.33 million (SGD 253 million) (2017) |

|||

|

Philippine Department of Health Philippine Health Insurance Corporation |

Republic Act 10351 (2012) 85% of incremental tobacco and alcohol tax revenue earmarked for health

|

||||

|

Republic Act 11467 (2020) I. Sugar-sweetened beverages (SSBs) 50% of the total excise taxes collected from sugar-sweetened beverages shall be allocated in the following manner:

|

|||||

|

II. Alcohol products 100% of the total revenues collected from excise taxes on alcohol products shall be allocated in the following manner:

|

|||||

|

III. Heated tobacco and vapor products 100% of the total revenues collected from excise taxes on heated tobacco and vapor products shall be allocated in the following manner:

|

|||||

| Earmarked Surcharge Tax | Lao PDR Tobacco Control Fund (2013)*** |

2% profit tax plus LAK 200 per pack 40,933 (LAK 779,128,800) (2022) 117,740 (LAK 1,004,912,730) (2018) 116,700 (LAK 945,266,000) (2017) |

|||

| Thai Health Promotion Foundation (ThaiHealth) (2001) |

121.43 million (THB 4.17 billion) (2023) 118.24 million (THB 4.08 billion) (2022) 122.63 million (THB 4.09 billion) (2021) 136.88 million (THB 4.09 billion) (2020) |

140.07 million (THB 4.17 billion) (2019) 124.87 million (THB 4.03 billion) (2018) 135.04 million (THB 4.4 billion) (2017) 119.80 million (THB 4.28 billion) (2016) |

|||

| Vietnam Tobacco Control Fund (2013) |

1% excise tax, effective 1 May 2013; 1.5% from 1 May 2016; 2%

from 1 May 2019 17.15 million (VND 405 billion) (2022) 16.26 million (VND 375 billion) (2020) 11.26 million (VND 261 billion) (2019) |

||||

| National Treasury Allocation | Malaysian Health Promotion Board (MySihat) (2006)**** |

1.91 million (MYR 7.5 million) (2018) 1.65 million (MYR 7.1 million) (2017) |

|||

| Indonesia Local Cigarette Tax (2014) |

Distribution of 10% local cigarette tax revenue to provinces

for health***** 1.52 billion (IDR 22.79 trillion) (2023) 1.27 billion (IDR 18.96 trillion) (2022) |

||||

* The budget also covers other NCD prevention programmes (healthy eating, physical activity, school health, and community programmes), in both children and adults.

** Budget for all health programmes under HPB and not solely for tobacco control.

*** This excludes the tax uncollected from imported brands as the tobacco industry refused to pay the 2% profit tax and LAK 200 per pack.

**** In June 2018, the Cabinet decided to abolish MySihat as part of the government’s rationalisation plan.

***** 10% local tobacco tax surcharged for social development (50% of the amount is for health - 75% of the 50% allocation for health is to be used for the National Health Insurance (Jaminan Kesehatan Nasional (JKN)) programme, 25% for maintenance of health facilities).

Thailand: Annual budget for health (2010-2022)

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ThaiHealth budget as percentage of combined MoPH budget + Fund for National Health Security (%) | 1.93 | 1.80 | 1.78 | 1.83 | 1.84 | 1.83 | 1.49 | 1.49 | 1.30 | 1.32 | 1.25 | 1.68 | 1.45 |

Thaihealth funding for selected major NCDs risk reduction programmes (2017-2022)

Support Tobacco Control in ASEAN

Your donation helps strengthen tobacco control efforts across

Southeast Asia, funding critical programs that save