The tobacco market in ASEAN was projected to sell 474.7 billion cigarettes in 2023, primarily in Indonesia,

Philippines, Thailand, and Vietnam.

Four of the world’s five largest TTCs – British American Tobacco (BAT), Philip Morris International (PMI),

Japan Tobacco International (JTI), and Imperial Brands (IB, formerly Imperial Tobacco Group) control the

cigarette markets in most countries in ASEAN. They have also expanded their product portfolio with

electronic nicotine delivery system (ENDS, also known as e-cigarettes) and heated tobacco products (HTPs).

The e-cigarette market value in four ASEAN countries (Indonesia, Malaysia, Philippines, and Vietnam) reached

USD 581.5 million in 2019 and was projected to grow by 30% (to USD 756.7 million) in 2023.

Two ASEAN countries (Indonesia and Vietnam) were among the world’s top 10 cigarette producers in 2022 and

2023. Indonesia, Philippines, and Singapore were among the world’s top 20 cigarette exporters in 2021. Five

ASEAN countries (Indonesia, Lao PDR, Myanmar, Philippines, and Thailand) were among the world’s top

tobacco-leaf-producing countries in 2021.

In an effort to enlarge their footprints in some ASEAN countries, TTCs are undertaking mergers and joint

ventures, resulting in increased market control by a few international companies. PMI has controlling stakes

in local cigarette companies in the Philippines and Indonesia. IB maintains its majority ownership in Lao

Tobacco Ltd (LTL), its joint venture with the Lao Government.

State-owned companies are the leading manufacturers in Thailand (Tobacco Authority of Thailand, formerly the

Thailand Tobacco Monopoly), and Vietnam (Vietnam National Tobacco Corp – VINATABA). PMI has the most (10)

manufacturing facilities located in ASEAN countries, followed by JTI (7), BAT (6), and IB (2).

The tobacco industry has been making billions in profits from selling cigarettes in ASEAN and worldwide with

the combined profit of the global top four TTCs (PMI, BAT, JTI, IB) estimated to be USD 22.7 billion in

2022.

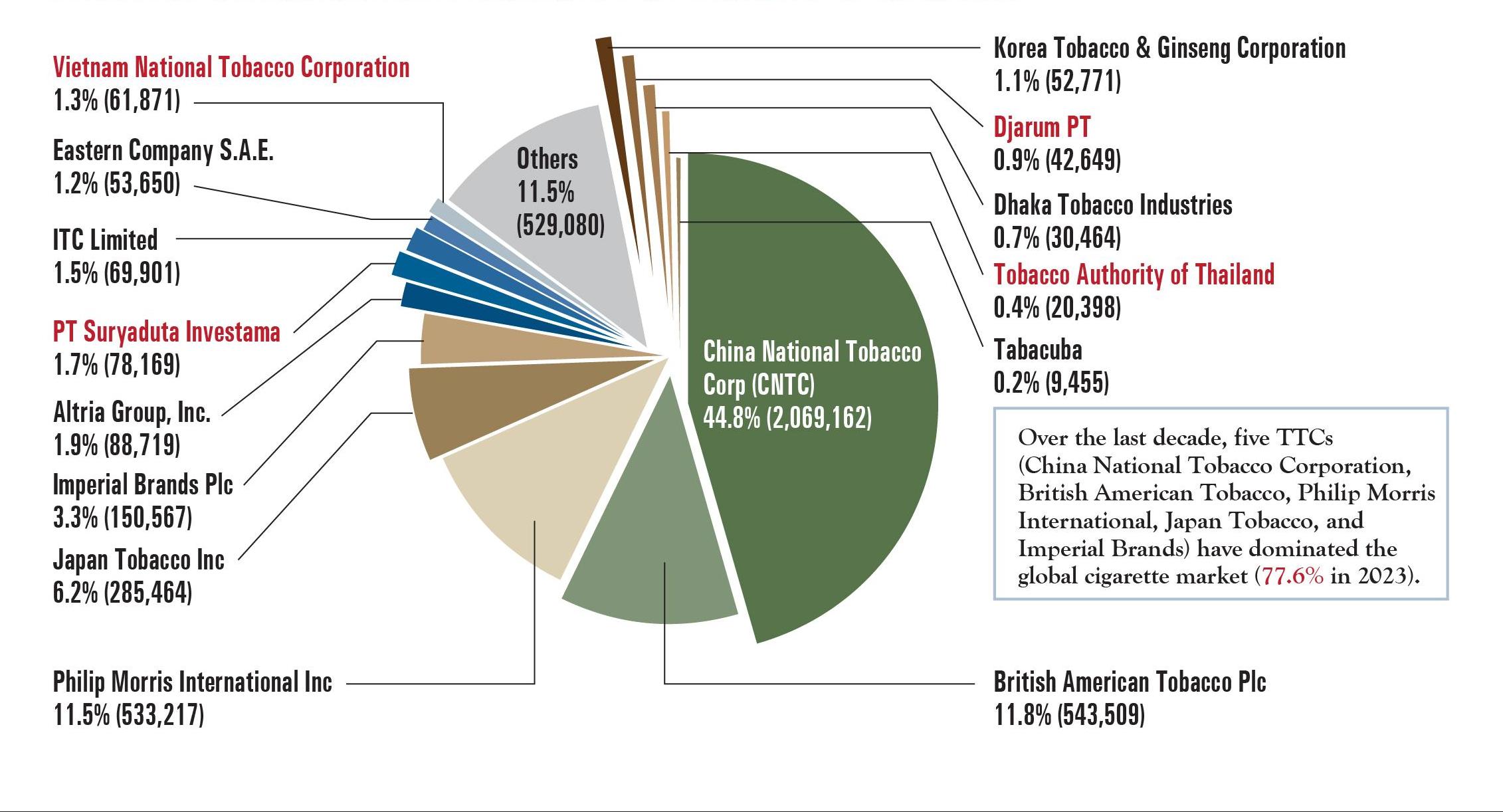

Four local tobacco companies in ASEAN in top 15 global cigarette producers (million cigarettes)

Tobacco industry profit in global market (2017 – 2023)

| Philip Morris International (PMI) | British American Tobacco (BAT)** | Japan Tobacco International (JTI) | Imperial Brands (IB) | |

|---|---|---|---|---|

| Cigarette and Tobacco-Related Factories | 31*** | 41 | 39 | 30 |

| Located in countries | 39 | 29 | 27 |

*The tobacco industry profit in 2022 and 2023 is the forecast data.

**No data available in 2023.

***An additional 8 facilities produce heated tobacco products, and 14 other facilities produce other tobacco and nicotine products for a total of 53 factories.

Excessive number of cigarette retailers in selected ASEAN countries

| Country | Total Smokers | Cigarette Retailers | Cig Retailer per 10,000 Smokers | Physicians per 10,000 Population |

|---|---|---|---|---|

| Indonesia | 63,138,469 | 2,400,000 | 380 | 7 |

| Malaysia | 4,786,400 | 80,000 | 167 | 23 |

| Philippines | 15,100,000 | 694,821 | 460 | 8 |

| Singapore | 287,569 | 4,313 | 150 | 28 |

| Thailand | 9,936,644 | 497,219 | 500 | 10 |

Tobacco manufacturing facilities in ASEAN

| Country | Philip Morris International (PMI) | Japan Tobacco International (JTI) | British American Tobacco (BAT) | Imperial Brands (IB) |

|---|---|---|---|---|

| Cambodia | Phnom Penh | Phnom Penh | ||

| Indonesia |

|

|

Malang | |

| Lao PDR* | Vientiane | |||

| Malaysia | Seremban** | Johor Bahru | ||

| Myanmar | Yangon | Yangon | ||

| Philippines |

|

|

||

| Singapore | Singapore | |||

| Vietnam | Can Tho City |

|

|

*In Lao PDR, Lao-China Hongta Good Luck Tobacco Co. (100% owned by Chinese investors and formerly called Lao-Chinese Lucky Tobacco Company) has the second largest marketshare in the country and the manufacturing facility is located in Savannakhet province.

**Philip Morris Malaysia (PMM) announced to discontinue its manufacturing plant in Malaysia in 2012 and currently operates a Cast Leaf plant in Seremban, which uses tobacco dustand stems to manufacture reconstituted tobacco to be used as one of the blend components in Primary Processing in the PMI manufacturing centers around the world. This 100% export facility is the largest in the world for PMI and its products are exported to PMI businesses around the globe.

In the Philippines, PMI has operated a tobacco leaf warehouse in the Subic Bay Free Port Zone (since at least 2009) and a manufacturing facility in the First Philippines Industrial Park. It received income tax holiday (ITH) for four (4) to a maximum eight (8) years; after the ITH, exemption from national and local taxes with only a special 5% tax rate on gross income; and exemption from duties and taxes on imported capital equipment spare parts, material and supplies.

With the approval of the amended CREATE Act, businesses in the Subic Free Port Zone may be eligible to receive an additional 6 years of ITH, a special rate for corporate income tax, exemption from VAT on importation for 16 years, and a VAT Zero-Rating on Local Purchase for 16 years beginning 2024.

Big transnational tobacco companies consolidating their power in ASEAN

| TTCs | Years | Acquisition/Merger/Partnership |

|---|---|---|

| Philip Morris International (PMI) | 2024 | Philip Morris International and its Philippine affiliate, PMFTC opened PHP 2.2 billion manufacturing facility in Batangas, Philippines on April 15 2024. The new manufacturing facility will produce tobacco sticks for PMI’s smoke-free products. |

| 2022 | Philip Morris International’s Indonesian subsidiary, PT HM Sampoerna Tbk, invested USD 186 million on a production factory of IQOS HEETS in Karawang, West Java, Indonesia. The production facility started operation in 2022 and was Philip Morris International’s (PMI) first production facility in Southeast Asia. | |

| 2010 | Philip Morris Philippines Manufacturing Inc merged with Fortune Tobacco Corp in 2010, creating Philip Morris Fortune Tobacco Corp (PMFTC) Inc., which is the largest tobacco company in the Philippines. | |

| 2005 | Philip Morris International bought 97% stake of the local cigarette manufacturer PT H.M. Sampoerna for USD 5.2 billion in 2005. It became the largest tobacco company in Indonesia. | |

| British American Tobacco (BAT) | 2009 | BAT acquired 85% stake of the PT Bentoel International Investama Tbk for USD 494 million, the 4th largest tobacco company in Indonesia in 2009. |

| Japan Tobacco International (JTI) | 2017 | Japan Tobacco Group acquired assets of Mighty Corporation (including its distribution network, manufacturing equipment, inventories and intellectual property for PHP 46.8 billion (USD 936 million) to become the second largest tobacco company in the Philippines. |

| 2007 | Japan Tobacco acquired Karyadibya Mahardhika (KDM) and its distributor, PT. Surya Mustika Nusantara (“SMN”), 100% stake of 2 subsidiaries of Gudang Garam for USD 677 million in Indonesia. | |

| Imperial Brands (IB) | 2001 | Imperial Tobacco, through its subsidiary, Coralma International (a French company) has a controlling stake in Lao Tobacco Ltd (LTL), its joint venture with the Lao Government that gave the company tax privileges and special benefits for 25 years. LTL is the largest tobacco company in Lao PDR. |

| Juul Labs | 2022 - 2023 | Juul Labs was 35% owned by Altria, the parent company of Philip Morris USA till December 2023, which made a USD12.8 Billion investment in JUUL. Juul Labs faced significant regulatory and legal challenges. In July 2022, Altria’s original investment has been substantially reduced and worth only 5% of its original value, pegging its fair value at USD 450 million. Additionally, in March 2023 that it has exchanged its entire investment with an annual royalty payment worth USD 250 million by December 2022, to irrevocable global license to certain of Juul’s heated tobacco intellectual property. |

| 2019 - 2020 | Juul Labs entered the Philippine market in June 2019 and partnered with Gokongwei-owned Better For You Corporation (BFY). In September 2020, it was reported that Juul is planning to pull out of 11 countries including Italy, Germany, Russia, Indonesia, and the Philippines. | |

| 2019 | Juul entered the Indonesia market in July 2019 with local partner PT Erajaya Swasembada Tbk, a distributor of Apple Inc.’s iPhones. However, in February 2022 (SE’s first comprehensive regulation launched in Indonesia), it announced that it is suspending its sales “indefinitely” because it cannot stop retailers from selling cigarettes to young people. | |

| KT&G | 2023 | KT&G Corporation (“KT&G”) invested in a new manufacturing plant (Next Generation Products (NGP)) in the East Java province, Indonesia (commencing operation in 2026 as an export hub) and received an agreement of support from the Ministry of Investment. |

This transaction is a tremendous strategic fit for our business that will cement our leadership in South East Asia.

Matteo Pellegrini, President of Phillip Morris in Asia 2010, referring to Philippines merger

Top 20 Global Cigarette Exporters (2021)

| RANK | COUNTRY | CIGARETTES (TONNES) |

|---|---|---|

| 1 | United Arab Emirates | 197,925 |

| 2 | Poland | 185,528 |

| 3 | Indonesia | 87,427 |

| 4 | Germany | 52,458 |

| 5 | Korea | 50,492 |

| 6 | Kenya | 39,629 |

| 7 | Lithuania | 38,414 |

| 8 | Romania | 37,361 |

| 9 | Turkey | 36,688 |

| 10 | Singapore | 35,734 |

| RANK | COUNTRY | CIGARETTES (TONNES) |

|---|---|---|

| 11 | Philippines | 34,722 |

| 12 | Czechia | 31,070 |

| 13 | Portugal | 30,194 |

| 14 | Serbia | 30,520 |

| 15 | Ukraine | 28,958 |

| 16 | Netherlands | 24,969 |

| 17 | Greece | 21,975 |

| 18 | Armenia | 19,990 |

| 19 | Switzerland | 18,804 |

| 20 | Russian Federation | 18,967 |

Top 20 Global Cigarette Importers (2021)

| RANK | COUNTRY | CIGARETTES (TONNES) |

|---|---|---|

| 1 | Germany | 226,514 |

| 2 | Israel | 57,241 |

| 3 | Italy | 55,995 |

| 4 | Iraq | 53,708 |

| 5 | Spain | 49,249 |

| 6 | France | 39,517 |

| 7 | Japan | 36,299 |

| 8 | Libya | 37,662 |

| 9 | Vietnam | 37,553 |

| 10 | Cambodia | 33,144 |

| RANK | COUNTRY | CIGARETTES (TONNES) |

|---|---|---|

| 11 | Netherlands | 32,812 |

| 12 | Singapore | 28,592 |

| 13 | United Arab Emirates | 27,738 |

| 14 | Belize | 25,568 |

| 15 | Saudi Arabia | 23,944 |

| 16 | Somalia | 22,735 |

| 17 | Thailand | 20,723 |

| 18 | United Kingdom and Northern Ireland | 18,993 |

| 19 | Syrian Arab Republic | 18,452 |

| 20 | United States of America | 17,194 |

The global tobacco market size was estimated at USD 867.55 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 2.1% from 2023 to 2030 due to the rising tobacco consumption in the developing regions of Asia and Africa.

Five ASEAN countries among world’s top tobacco-leaf producing countries (2021)

Tobacco leaf production in ASEAN (2015 – 2022)

More than 300 million people globally acute food insecurity. Meanwhile 3.2 million hectares of land across 124 countries are being used to grow deadly tobacco, even in countries where people are starving. Globally, 79 countries are facing acute food insecurity, and the majority are low- and middle-income countries, where tobacco is reported increasingly grown.

Top 10 global cigarette markets (2022 and 2023)

Global cigarette consumption (2016 – 2025)

Despite a global decline, cigarette sales are still very

high. More than 4.5 trillion cigarettes) are consumed

annually. Cigarettes continue to dominate the global

tobacco product marketplace despite claims by major

tobacco companies of shifting to non-cigarette

products such as e-cigarettes and heated tobacco

products.

The revenue of the global tobacco products market

was USD 912 billion as of 2022 and is projected to

grow at a compound annual growth rate (CAGR) of

3.75% from 2023 to 2028.

*Data between 2021 and 2025 are projections.

ASEAN cigarette consumption (2017 - 2028)

*Data between 2023 and 2028 are forecast sales.

Cigarette sales volumes are highest in Indonesia, Philippines, Thailand and Vietnam

*Forecast sales.

Cigarette sales volumes in Cambodia, Lao PDR, Malaysia, Myanmar and Singapore

*Forecast sales.

Globally, more than 8 million deaths and at least USD 2

trillion in economic losses are causes by tobacco every year.

In ASEAN, an estimated 1.39 billion cancer sticks were consumed daily by adult

smokers.

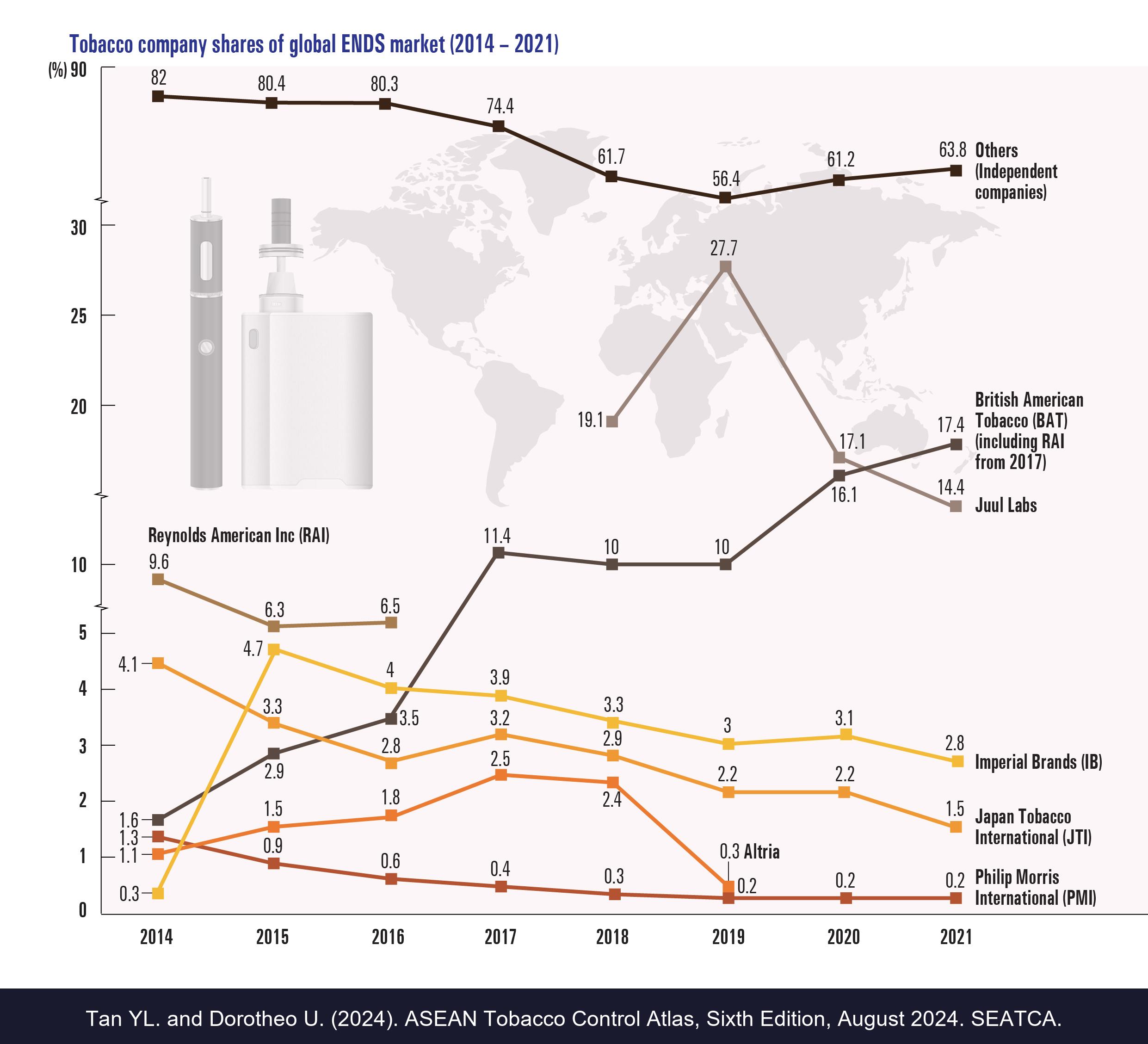

The global tobacco industry is dominated by five transnational tobacco companies (TTCs), all with a

presence in Asia: China National Tobacco Corporation (CNTC), Philip Morris International (PMI),

British American Tobacco (BAT), Japan Tobacco Inc. (JTI), and Imperial Brands. These TTCs have

also ventured into electronic nicotine delivery systems (ENDS) and heated tobacco products (HTPs)

and are accessing many countries in Asia as fast-growing markets for expansion.

The Asia Pacific region is a key target of tobacco companies, with e-cigarette nearly doubled to USD

1.4 billion between 2014 and 2018. The market continues to grow rapidly to USD 2.2 billion in 2019,

it doubled again to USD 4.4 billion in 2021, making it the fastest-growing regional market in terms of

value.

Tobacco company shares of global ENDS market (2014 – 2021)

In 2019, the Electronic Nicotine Delivery System (ENDS) market value in four ASEAN countries

(Indonesia, Malaysia, Philippines and Vietnam) was USD 581.5 million, and it is projected to grow by

30% (to USD 756.7 million) in 2023.

E-commerce is a significant and growing sales channel in the

region, with most of the popular or

featured brands in online shops originating from China. Southeast Asian youth are targeted with a

wide variety of flavours, trendy designs, and point-of-sale promotions, and several e-cigarette related

injuries and diseases have been reported in the region.

ENDS market size in ASEAN (2015 – 2023)

*Forecast sales.

The global e-cigarette market is projected to grow from USD 22.5 billion in 2022 to USD 47.5 billion in 2028 at a compound annual growth rate (CAGR) of 13.5% during the forecast period 2023 to 2028.

Corporate Cover Up: PMI, BAT and JTI CSR in ASEAN

Tobacco companies continue to promote themselves as “good corporate citizens” to create and

maintain a positive public view of its business, to divert attention from and whitewash the diseases and

other harms caused by the products they manufacture and sell, and to gain access to high-level officials

and policy makers and thereby unduly influence and corrupt tobacco regulatory policy development

and implementation.

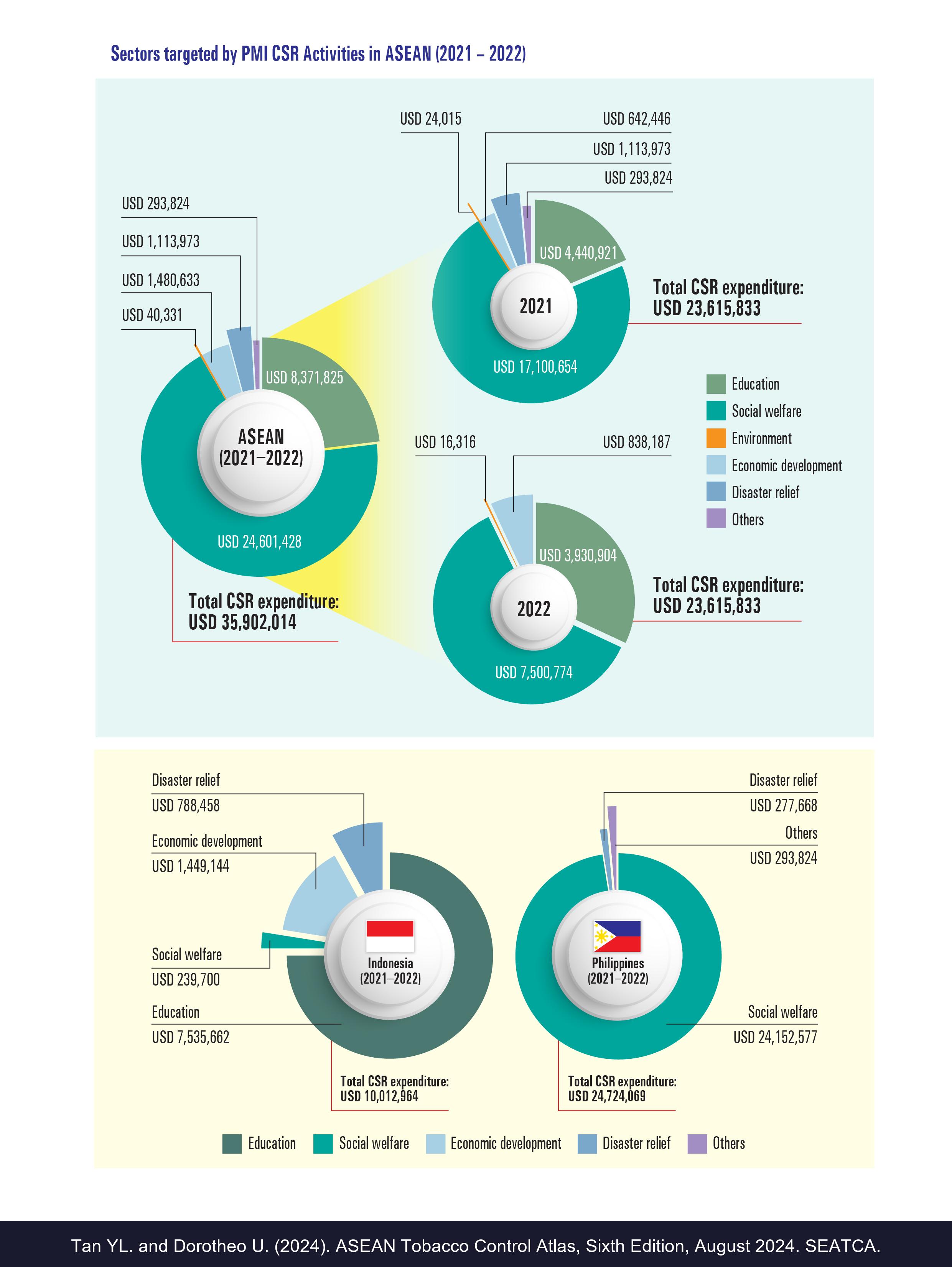

During the peak of the COVID-19 pandemic, Philip Morris International substantially increased its

investment in so-called Corporate Social Responsibility (CSR) endeavors across the ASEAN region

from 2019 to 2021, with funds soaring from USD 9,566,715 in 2019 to USD 23,615,833 in 2021.

However, it concurrently halved the number of organizations through which these funds were

channeled.

PMI continues to dissociate its CSR initiatives from its core tobacco business by engaging foundations

or civic organizations to execute these activities. In 2021, the majority of funds were directed to a single

entity in the Philippines, the Jaime V. Ongpin Foundation Inc. (JVOFI).

By 2022, there was a noticeable decline of nearly 50% in CSR contributions across the region, plummeting

from USD 23,615,833 in 2021

to USD 12,286,181 in 2022. Although the USD 12.3

million allotted for CSR initiatives might seem substantial, it represents a mere fraction (0.03%) of the

company’s USD 31.8 billion net revenue during the same period.

Of notable importance is the distribution of these contributions, with the Philippines getting the

largest share (USD 7,404,496 in 2022). This allocation, primarily directed to JVOFI, surpasses the total

CSR disbursements in all other ASEAN nations combined. Meanwhile, in Thailand, the CSR fund is

routed through farmers' associations.

A discernible trend over recent years indicates an overall reduction in the number of organizations

receiving sponsorship from PMI, though there is a slight increase in contributions to select

organizations in Malaysia and Thailand. This consolidation of CSR funds into fewer organizations may

suggest that PMI is becoming more discerning in its CSR focus areas or attempting to create the

perception of a more substantial impact with its contributions.

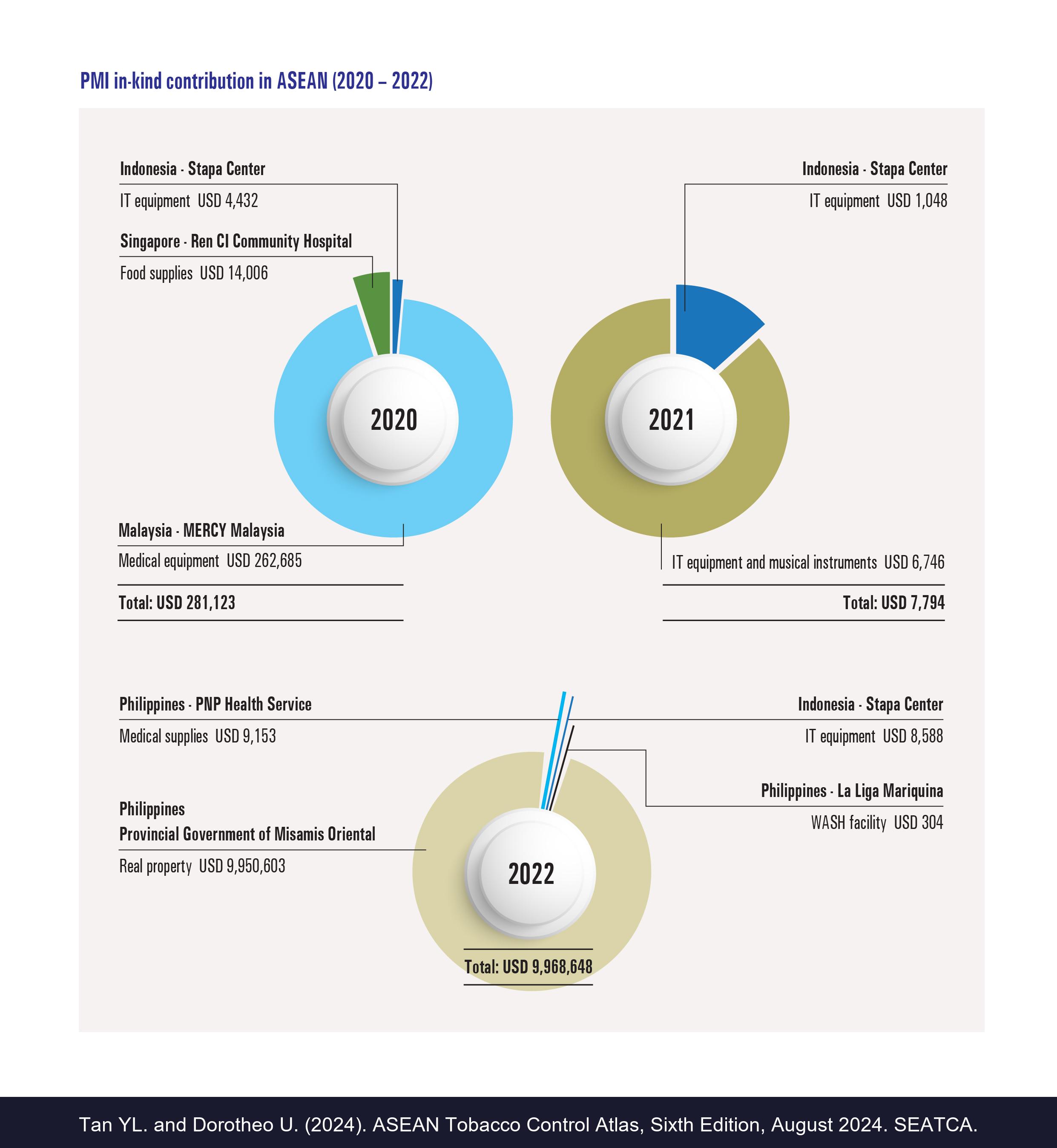

In addition, PMI also provided in-kind contributions equivalent to USD 9,959,495 in 2021 (increased

from USD 281,123 in 2020) to organizations in Indonesia, Malaysia, Philippines, and Singapore.

Philip Morris International activities in ASEAN (2019 – 2022)

What TTCs spend on CSR activities is paltry compared to the remuneration paid to their top executives. Jacek Olczak, CEO of PMI, alone was paid almost more than PMI’s total expenditure on CSR activities in the ASEAN region in 2022

Tobacco industry’s miniscule CSR spending in ASEAN compared to its profits and remuneration for the CEO

| TTCs | CEO | Remuneration in 2022 (USD million) |

2022 profits in global market* (USD billion) |

Total CSR expenditures in ASEAN (USD million) |

|---|---|---|---|---|

| Philip Morris International (PMI) | Jack Olczak | 15.77 | 9.05 | 12,286.181 (2022) |

| British American Tobacco (BAT) | Jack Bowles Tadeu Marroco |

11.94 6.35 |

8.22 | No data available |

| Imperial Brands | Stefan Bomhard | 7.39 | 1.93 | No data available |

| Japan Tobacco International (JTI) | Eddy Pirard | No data available | 3.27 | 2.61 (2016-2019) |

*2022 data on industry profits is not available.

A PMI executive has stated clearly that their corporate giving is not charitable:

"I never use the word corporate philanthropy. That implies that you do something without any regard to yourself... I don't see any corporation giving money without a reason.”

Top 4 ASEAN countries receiving PMI CSR funding (2011 – 2022)

Sectors targeted by PMI CSR Activities in ASEAN (2021 – 2022)

PMI in-kind contribution in ASEAN (2020 – 2022)

More than USD 50 billion a year of profit (USD 10,000 per tobacco death) enables the tobacco industry’s powerful public relations, marketing, and scientific arms to present themselves in a positive light, making donations of cash, protective equipment, ventilators, and other health support to governments and health-care systems, while aggressively marketing of new addictive products.

Legal challenges of the tobacco industry to undermine tobacco control in ASEAN

Thailand

Philippines

- 3 court cases

- PMPMI, FTC, JTI, Mighty, La Suerte vs DOH regarding AO 2010-13 requiring graphic health information (5 separate cases filed in 2010).

- PTI vs DOH and FDA regarding power to regulate tobacco products (in 2011).

- PMFTC vs DOH regarding tobacco promotions (2 separate cases filed in 2011 and 2012).

- PTI for declaratory relief regarding outdoor advertising (in 2007).

- Individuals (Anthony M. Clemente and Vrianne I. Lamson) reportedly paid by PMFTC vs MMDA regarding smoke-free (in 2011).

- PTI vs. City of Balanga regarding city ordinance making the city's 80-hectare University Town and its three-kilometer radius "tobacco free” (in 2017).

- PTI vs. City of Balanga regarding tobacco free generation ordinance (in 2018).

- Green Puff Electronic Cigarettes Inc. and Ryan Sazon vs DOH, Manila RTC and Ryan Leopando Sazon vs DOH, Pasig RTC were filed against DOH Administrative Order (AO) No. 2019-0007 that classified electronic cigarettes as health or consumer products under the jurisdiction of the FDA (in 2019).

Malaysia

- 2 court cases

- Judicial review by seven Malaysian smokers on a smoking ban in eateries that was enforced in January 2019.

- Judicial review by British American Tobacco (BAT) for "mini-cigar" - Dunhill HTL-Cigarillo in November 2019.

Indonesia

- 13 court cases

- Six judicial reviews (2010 - 2012) of the Law No 36/2009 concerning health, including tobacco control, pictorial health warnings, and smoke-free regulations.

- Two judicial reviews (2011) of the DKI Jakarta Governor Regulation No 88/2010 concerning smoking areas.

- A judicial review (2011) of the Bogor City Regional Regulation No 12/2009 concerning No-Smoking Areas and another judicial review (2020) of the amendments to the Regional Regulation No 12/2009 concerning the non-smoking area and the prohibition of displaying cigarettes at the point of sale.

- A judicial review (2011) of the Joint Regulations of the Minister of Home Affairs and the Minister of Health regarding guidelines for implementing a no-smoking area in 3 different files.

- A judicial review (2013) of the Law No 28/2009 concerning regional taxes and regional levies, related to regional cigarette taxes.

- CSO "Healthy Jogja Without Tobacco" (JSTT) was sued by tobacco farmers for unlawful acts of using the word "Tobacco" for the name of the organization in 2014.

- A judicial review (2020) of the Regional Regulation of the City of Bogor No 10/2018 concerning amendments to the Regional Regulation of the City of Bogor No 12/2009 regarding the non-smoking area and prohibition of displaying cigarettes at the point of sale.

Tobacco Industry front groups and lobby groups to fight tobacco control

The tobacco industry rallies and funds front groups to fight tobacco control measures at both international and national level. The tobacco industry includes any (a) tobacco or tobacco product (including electronic smoking devices (ESD)) manufacturer, processor, wholesale distributor, importer, (b) parent, affiliate, branch, or subsidiary of a tobacco or tobacco product (including ESD) manufacturer, wholesale distributor, importer, retailer, or (c) any individual or entity, such as, but not limited to an interest group, think tank, advocacy organization, lawyer, law firm, scientist, lobbyist, public relation, and/or advertising agency, business, or foundation, that represents or works to promote the interests of the tobacco and nicotine industry.

The International Tobacco Growers Association (ITGA) is one such group which mobilizes tobacco growers to interfere in tobacco control policy development in ASEAN countries and fight FCTC implementation. Other front groups include retailers and trade associations, coffee shop associations or research groups, which challenge tobacco control legislation.

| Type | Country | Front groups and lobby groups in ASEAN | |

|---|---|---|---|

| Tobacco | Ends | ||

| Farmers Groups | Regional / international | International Tobacco Growers Association (ITGA) | |

| Indonesia |

|

||

| Philippines |

|

||

| Thailand |

|

||

| Manufacturer Associations | Cambodia | Association of Tobacco Industry in Cambodia (ATIC) | |

| Indonesia |

|

|

|

| Myanmar |

|

||

| Philippines |

|

Philippine E-cigarette Industry Association (PECIA) | |

| Singapore | Tobacco Association (Singapore) | ||

| Lao PDR | Lao Tobacco Ltd | ||

| Philippines | National Tobacco Administration (NTA) | ||

| State-owned company/ State agency | Lao PDR | Lao Tobacco Ltd | |

| Philippines | National Tobacco Administration (NTA) | ||

| Thailand | Tobacco Authority of Thailand (TAOT) | ||

| Vietnam |

|

Vietnam Tobacco Association (VTA) | |

| Retailer Groups | Regional | Asia Pacific Travel Retail Association (Singapore) | |

| Cambodia | Dufry (Cambodia) Ltd | ||

| Indonesia | Himpunan Peritel dan Penyewa Pusat Perbelanjaan Indonesia (Hippindo) | ||

| Malaysia | Malaysia Retail Electronic Cigarette Association (MRECA) | ||

| Philippines |

|

||

| Singapore |

|

||

| Business Groups | Regional |

|

|

| Indonesia | Forum Komunikasi Pengusaha Rokok Kecil (FKPRK) - Communication Forum of Small Cigarette Businessmen |

|

|

| Malaysia |

|

|

|

| Philippines |

|

||

| Singapore |

|

||

| Thailand | Thai Tobacco Trade Association (TTTA) | ||

| Vietnam | Vietnam Chamber of Commerce and Industry (VCCI) | ||

| Consumer / Astroturf Groups | Regional / International |

|

|

| Indonesia |

|

|

|

| Malaysia | Malaysian Vape Industry Advocacy (MVIA) | ||

| Philippines | Proyosi Inc / Nicotine Consumers Union of the Philippines |

|

|

| Thailand | Thai Smokers Group (TSG) | End Cigarette Smoke Thailand Group (ECST) | |

| Vietnam | Vietnam Consumer Protection Association (VCPA) | ||

| Labor / Workers Group | Indonesia | Federasi Serikat Pekerja Rokok, Tembakau, Makanan Minuman (FSP RTMM-SPSI) – Federation of Trade Unions of Cigarette, Tobacco, Food and Beverages | |

| Philippines | Trade Union Congress of the Philippines (TUCP) | ||

| Thailand | Tobacco Authority of Thailand Workers Union | ||

| Think Tanks / Legal | Regional / International |

|

|

| Lao PDR | Lao Law & Consultancy Group | ||

| Malaysia | Institute for Democracy and Economic Affairs (IDEAS) |

|

|

| Philippines | Minimal Government Thinkers | Ascra Consulting Inc. | |

| Foundation/ CSR Group | Regional / International |

|

|

| Indonesia |

|

||

| Malaysia | BAT Malaysia Foundation | ||

| Philippines |

|

Support Tobacco Control in ASEAN

Your donation helps strengthen tobacco control efforts across Southeast Asia,

funding critical programs that save