Dev - Profiting from Deadly Products

In the global tobacco market, transnational tobacco companies (TTCs) have been shifting from developed countries and targeting markets in poorer, less developed countries where tobacco control is not as stringent and where tobacco use is significantly high among men and attractively low among women. In 2020, the tobacco market growth in ASEAN is projected to reach a total of 505.65 billion cigarettes sold, primarily in Indonesia, Philippines, Thailand, and Vietnam.

Four of the world's five largest TTCs - British American Tobacco (BAT), Philip Morris International (PMI), Japan Tobacco International (JTI) and Imperial Brands (IB) control the cigarette markets in most countries in ASEAN such as Cambodia, Indonesia, Lao PDR, Malaysia, Philippines, Singapore, Thailand and Vietnam. They have also ventured into electronic nicotine delivery systems (ENDS, also known as e-cigarettes) and heated tobacco products (HTPs) to expand their nicotine and tobacco market. The ENDS market value in four ASEAN countries (Indonesia, Malaysia, Philippines and Vietnam) reached USD 581.5 million in 2019 and projected to grow by 30% (to USD 756.7 million) in 2023.

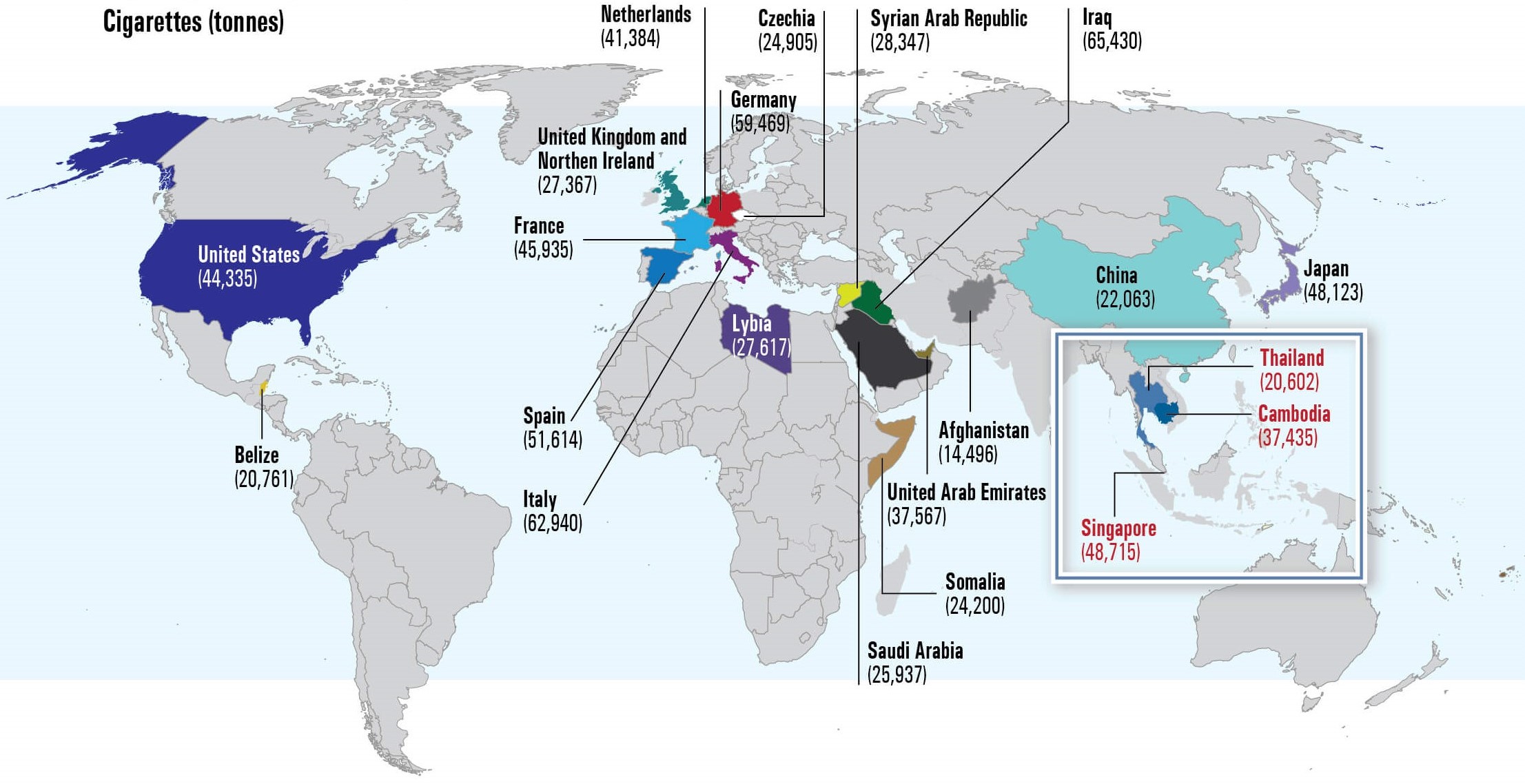

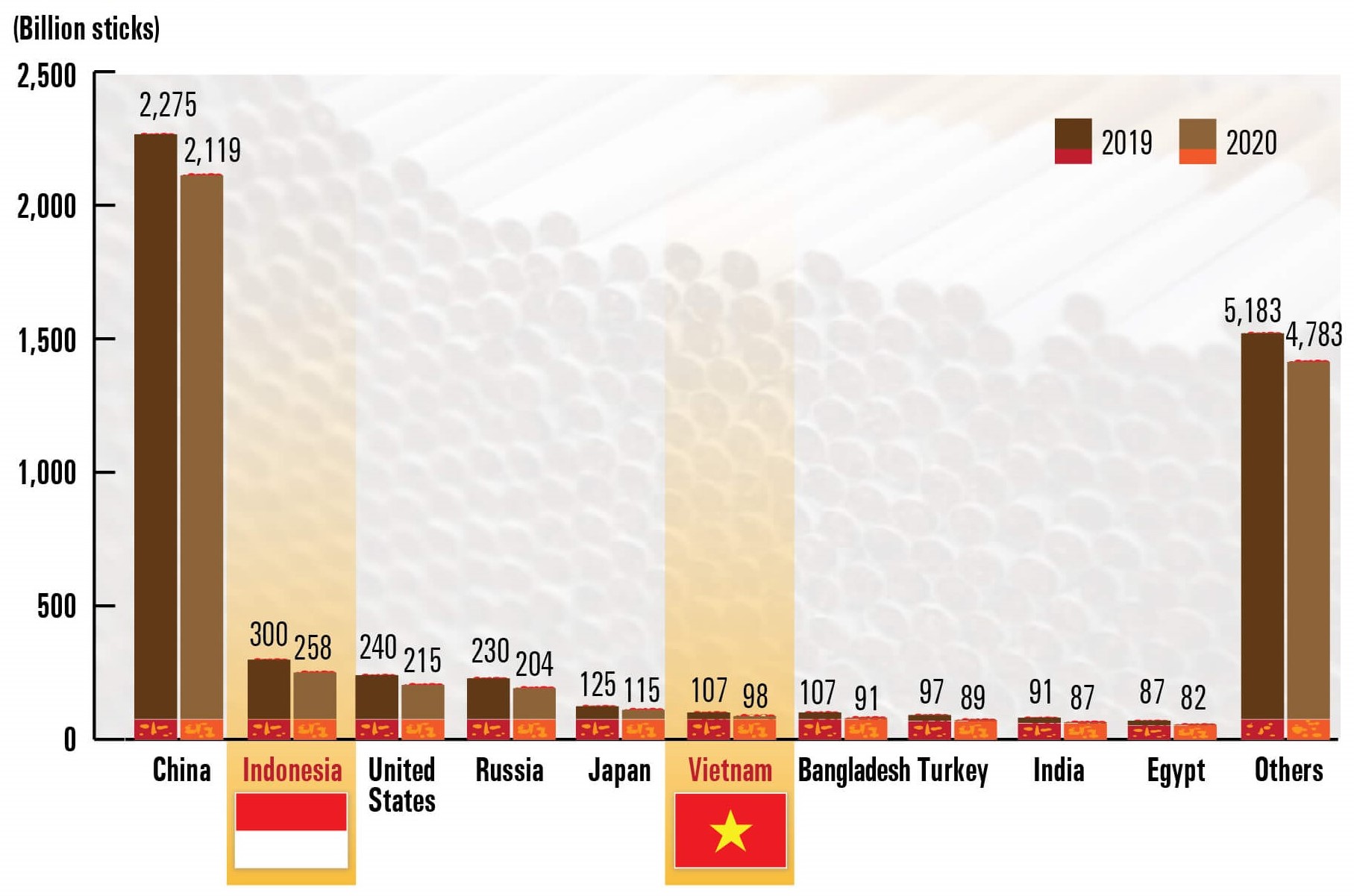

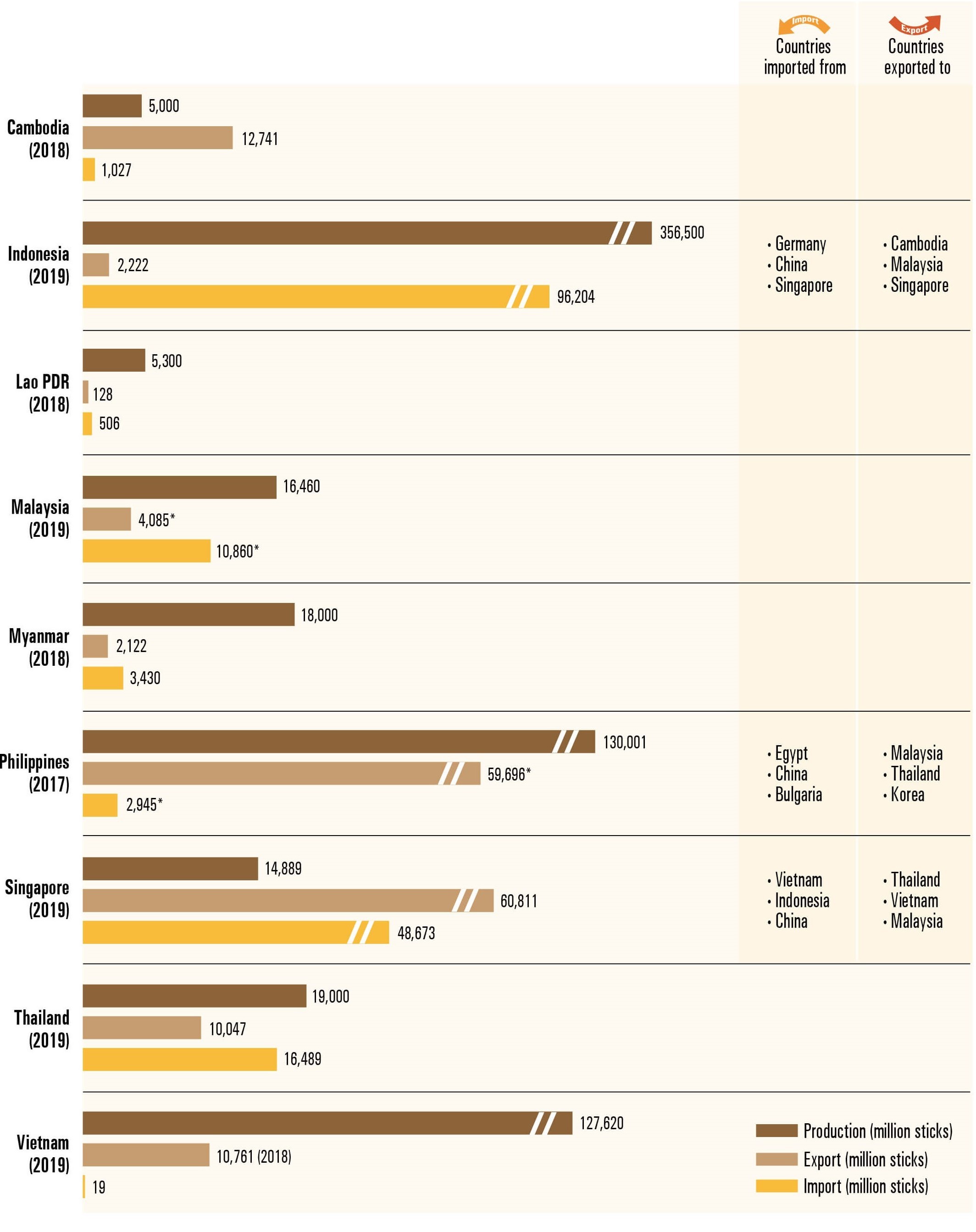

In 2020, tobacco manufacturers in seven ASEAN countries (Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam) produced 682.47 billion cigarettes. Two ASEAN countries (Indonesia and Vietnam) were among the world's top 10 cigarette markets in 2020. Indonesia, Philippines and Singapore were among the world top 20 cigarette exporters in 2019.

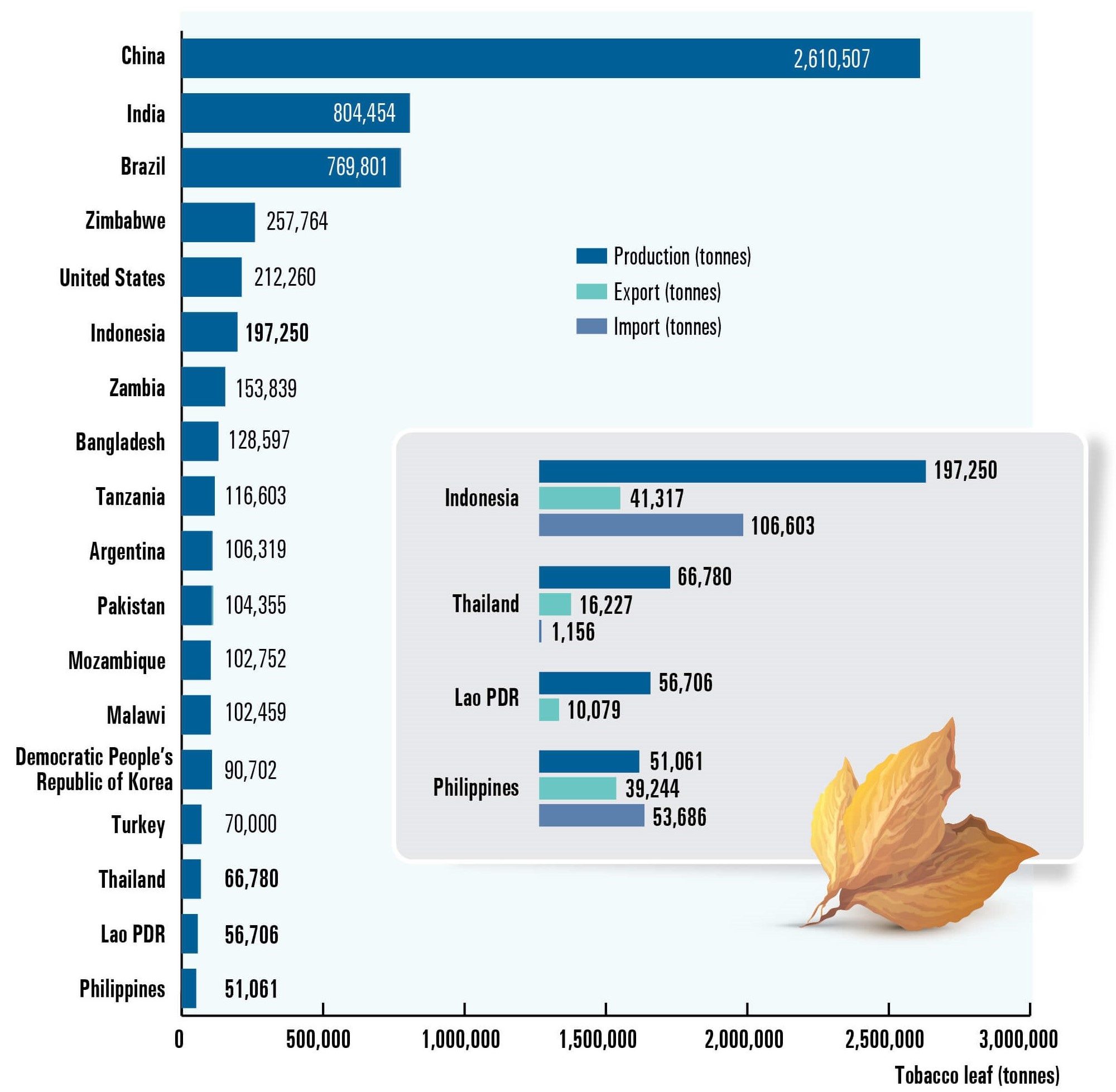

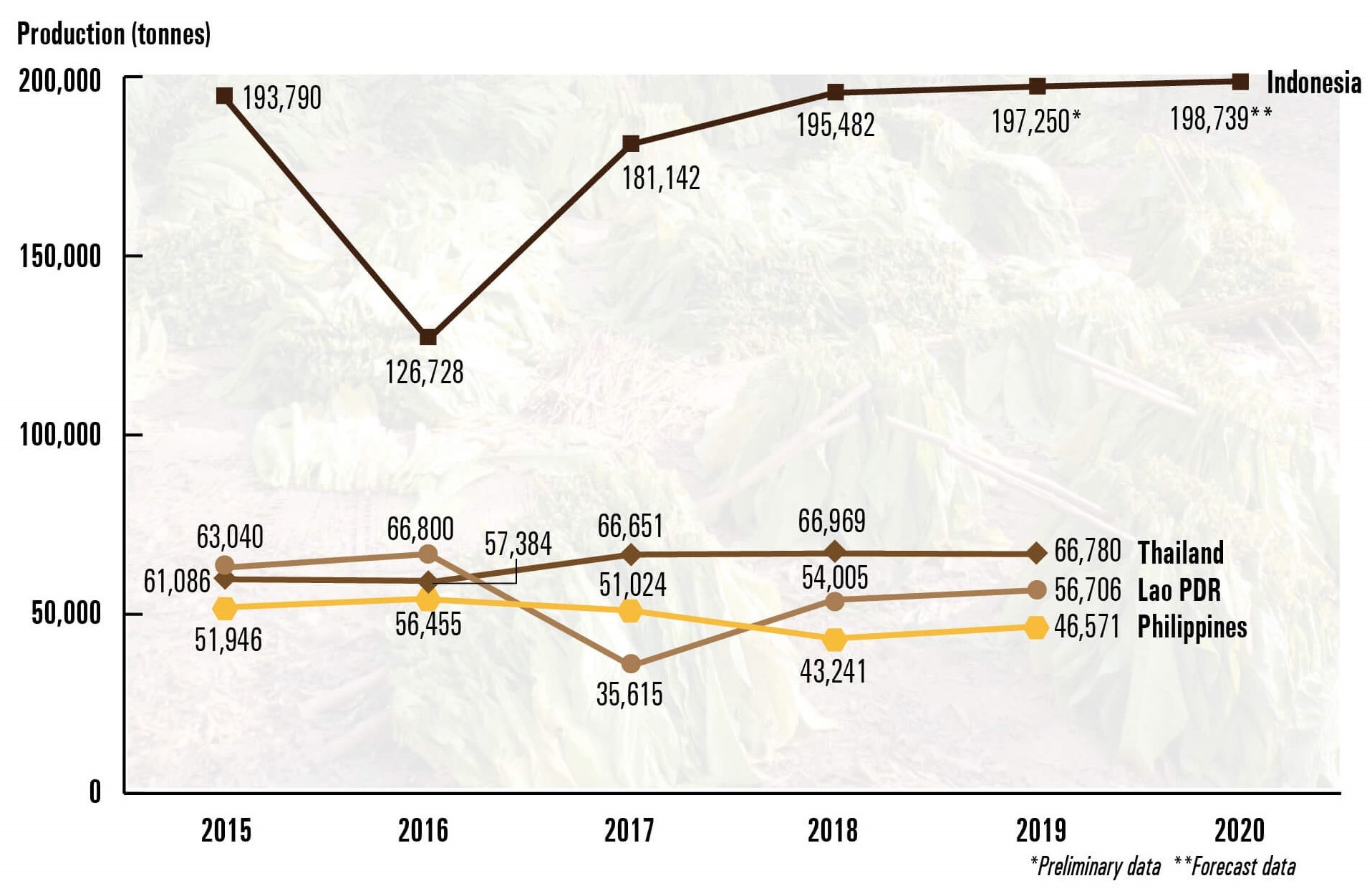

Another four ASEAN countries (Indonesia, Lao PDR, Philippines and Thailand) were among world's top tobacco-leaf producing countries in 2019. In an effort to enlarge their footprints in some ASEAN countries, TTCs are undertaking mergers and joint ventures, resulting in increased market control by a few international companies. PMI has bought controlling stakes in local cigarette companies in the Philippines and Indonesia. Imperial Brands (IB) (formerly Imperial Tobacco Group) maintains its majority ownership in Lao Tobacco Ltd (LTL), its joint venture with the Lao Government. State-owned companies are the leading manufacturers in Thailand (Tobacco Authority of Thailand, the former Thailand Tobacco Monopoly - TTM) and Vietnam (Vietnam National Tobacco Corp - VINATABA).

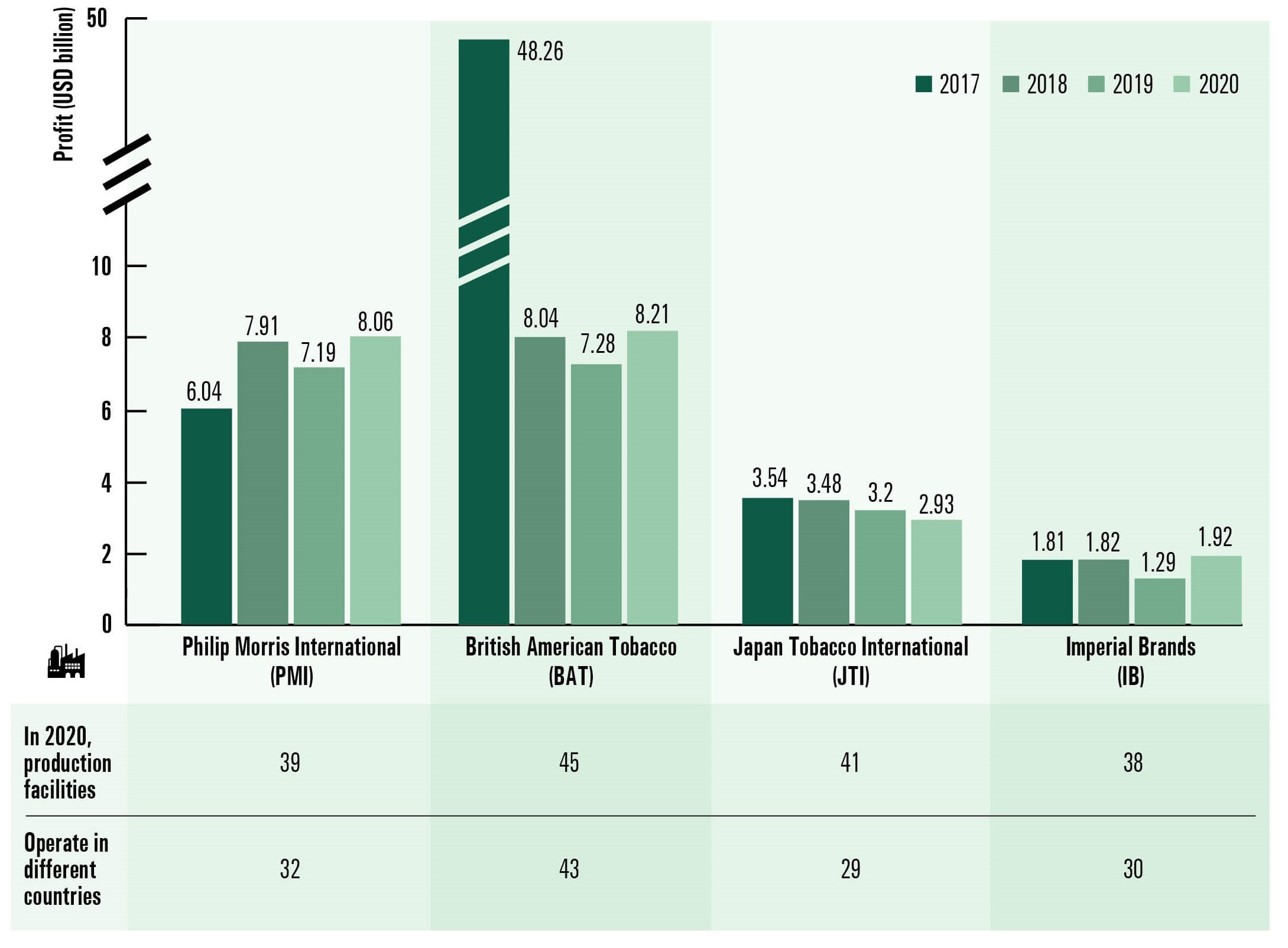

PMI has the most (20 out of 39) manufacturing facilities located in ASEAN countries, while JTI, BAT and IB operate six, six and two manufacturing facilities, respectively, in selected ASEAN countries. The tobacco industry has been making billions in profits from selling cigarettes in ASEAN and worldwide with combined profit of the global top four TTCs (PMI, BAT, JTI, IB) estimated to be USD 21.12 billion in 2020.

Tobacco company shares of global cigarette market, 2019

Tobacco Industry profit in global market (2017 - 2020)

Excessive number of cigarette retailers in selected ASEAN countries

| Country | Total smokers | Cigarette retailers (total) | Cigarette retailers (per 10K smokers) | Physicians per 10,000 pop |

|---|---|---|---|---|

| Indonesia | 65,700,000 | 2,400,000 | 381 | 4 |

| Malaysia | 4,877,697 | 80,000 | 164 | 15 |

| Philippines | 16,500,000 | 694,821 | 421 | 6 |

| Singapore | 323,000 | 4,443 | 138 | 23 |

| Thailand | 10,676,362 | 527,839 | 494 | 8 |

| Vietnam | 15,602,400 | 303,333* | 194 | 8 |

| Philip Morris International (PMI) | Japan Tobacco International (JTI) | British American Tobacco (BAT) | Imperial Brands (IB) | |

|---|---|---|---|---|

| Total | 20 | 6 | 6 | 6 |

| Cambodia | Phnom Penh | Phnom Penh | ||

| Indonesia | Bantul, Bekasi, Blora, Bojonegoro, Cepu, Depok, Karawang, Kertosono, Malang, Mranggen, Ngoro, Pandaan, South Pandaan, Pasuruan, Probolinggo, Surabaya |

Jakarta Selatan* East Java* |

Jakarta Selatan* Malang Bekasi** |

Jakarta** |

| Lao PDR | Vientiane | |||

| Malaysia | Seremban*** | Kuala Lumpur | Kuala Lumpur | |

| Myanmar | Yangon | Yangon | ||

| Philippines | Tanauan City, Batangas, Marikina City |

Malolos City, Bulacan Malvar, Batangas |

||

| Singapore | Singapore | |||

| Vietnam | Ho Chi Minh City | Ho Chi Minh City | Ho Chi Minh City | Ho Chi Minh City |

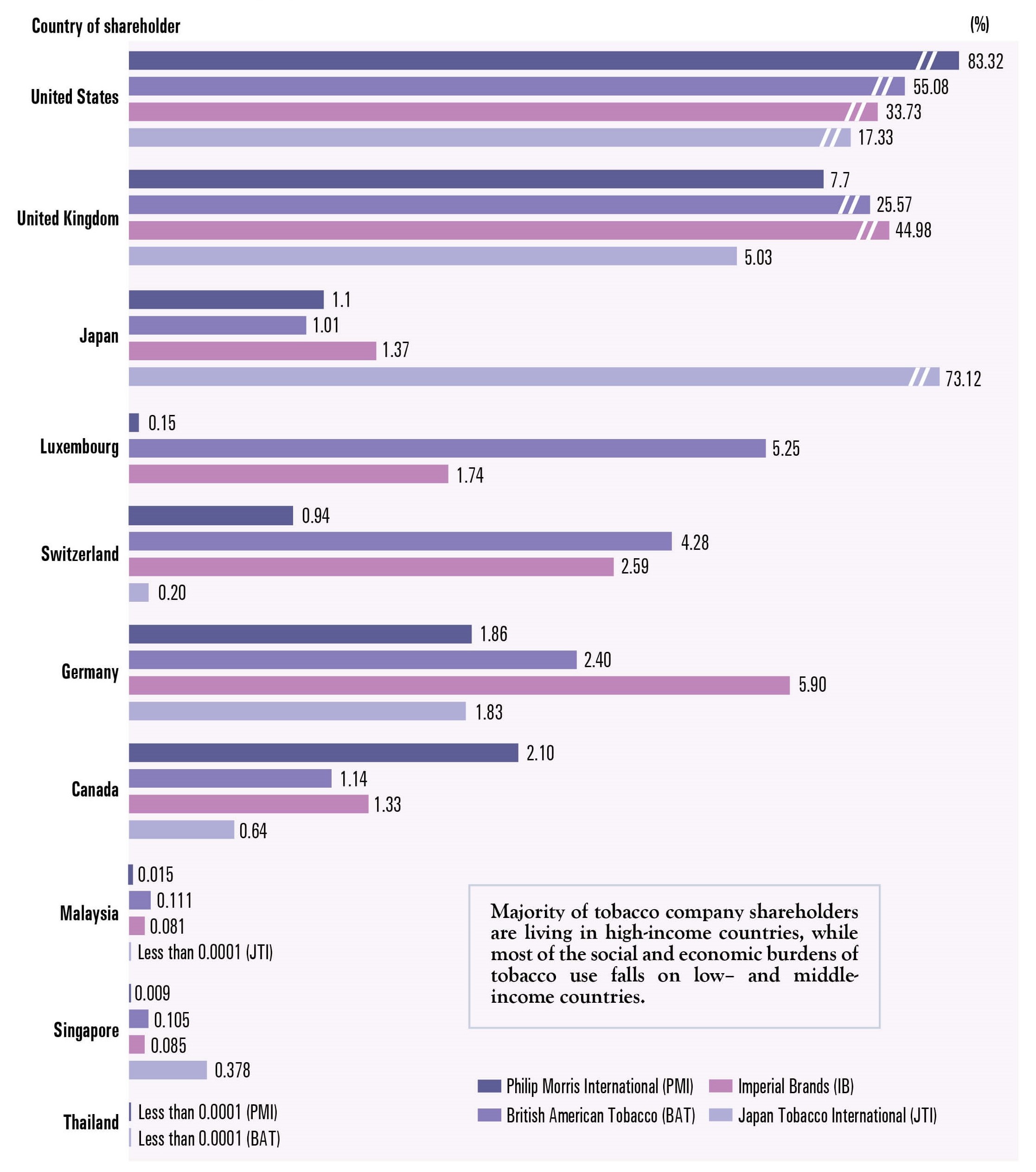

Less than 1% of tobacco company shareholders domiciled in ASEAN

Big transnational tobacco companies consolidating their power in ASEAN

| TTCs | Year | Acquisition/Merger/Partnership |

|---|---|---|

| Philip Morris International (PMI) | 2010 | Philip Morris Philippines Manufacturing Inc merged with Fortune Tobacco Corp in 2010, creating Philip Morris Fortune Tobacco Corp (PMFTC) Inc., which is the largest tobacco company in the Philippines. |

| 2005 | Philip Morris International bought 97% stake of the local cigarette manufacturer PT H.M. Sampoerna for USD 5.2 billion in 2005. It became the largest tobacco company in Indonesia. | |

| British American Tobacco (BAT) | 2009 | BAT acquired 85% stake of the PT Bentoel Internasional Investama Tbk for USD 494 million, the 4th largest tobacco company in Indonesia in 2009. |

| Japan Tobacco (JT) | 2017 | Japan Tobacco Group acquired assets of Mighty Corporation (including its distribution network, manufacturing equipment, inventories and intellectual property) for PHP 46.8 billion (USD 936 million) to become the second largest tobacco company in the Philippines. |

| Japan Tobacco acquired Karyadibya Mahardhika (KDM) and its distributor, PT. Surya Mustika Nusantara (“SMN”), 100% stake of 2 subsidiaries of Gudang Garam for USD 677 million in Indonesia. | ||

| Imperial Brands | 2001 | Imperial Tobacco, through its subsidiary, Coralma International (a French company) has acontrolling stake in Lao Tobacco Ltd (LTL), its joint venture with the Lao Government that gave the company tax privileges and special benefits for 25 years. LTL is the largest tobacco company in Lao PDR. |

| KT&G | Korea Tobacco & Ginseng Corporation (KT&G) - KT&G acquired 60% stake of PT Trisakti Purwosari Makmur, a local cigarette manufacturer for the USD 133 million, the sixth largest company in Indonesia. | |

| JUUL | 2019 | Juul Labs entered the Philippine market in June 2019 and partnered with Gokongwei-owned Better For You Corporation (BFY). Juul Labs is 35% owned by Altria, the parent company of Philip Morris USA. |

| Juul entered the Indonesian market in July with local partner PT Erajaya Swasembada Tbk, a distributor of Apple Inc.'s iPhones. |

“This transaction is a tremendous strategic fit for our business that will cement our leadership in South East Asia.”

Top 20 global cigarette exporters (2019)

Top 20 global cigarette importers (2019)

Four ASEAN countries among world's top tobacco-leaf producing countries (2019)

Indonesia, Lao PDR, Philippines and Thailand: Tobacco leaf production (2015 - 2020)

Top 10 global cigarette markets

Cigarette production, import and export in ASEAN

The global tobacco industry is dominated by five transnational tobacco companies (TTCs), all with a presence in Asia: China National Tobacco Corporation (CNTC), Philip Morris International (PMI), British American Tobacco (BAT), Japan TobaccoInc. (JTI), and Imperial Tobacco Group (ITG). All these TTCs have ventured into electronic nicotine delivery systems (ENDS)and heated tobacco products (HTPs) and are accessing many countries in Asia as fast-growing markets for expansion.

Tobacco company shares of global ENDS market (2014 - 2019)

ENDS market size in ASEAN (2015 - 2023)

Corporate cover up: PMI, BAT and JTI CSR in ASEAN

Tobacco companies promote themselves as “good corporate citizens” to divert attention from the diseases and other harms

caused by the products they manufacture and sell and to unduly influence and corrupt tobacco regulatory policy development

and implementation.

The tobacco industry has stepped up its corporate social responsibility (CSR) activities across the world during the COVID-19

pandemic. It continues to hand out CSR to create and maintain a positive public view of its business, whitewash the harms

caused by its products, and gain access to high-level officials and policy makers.

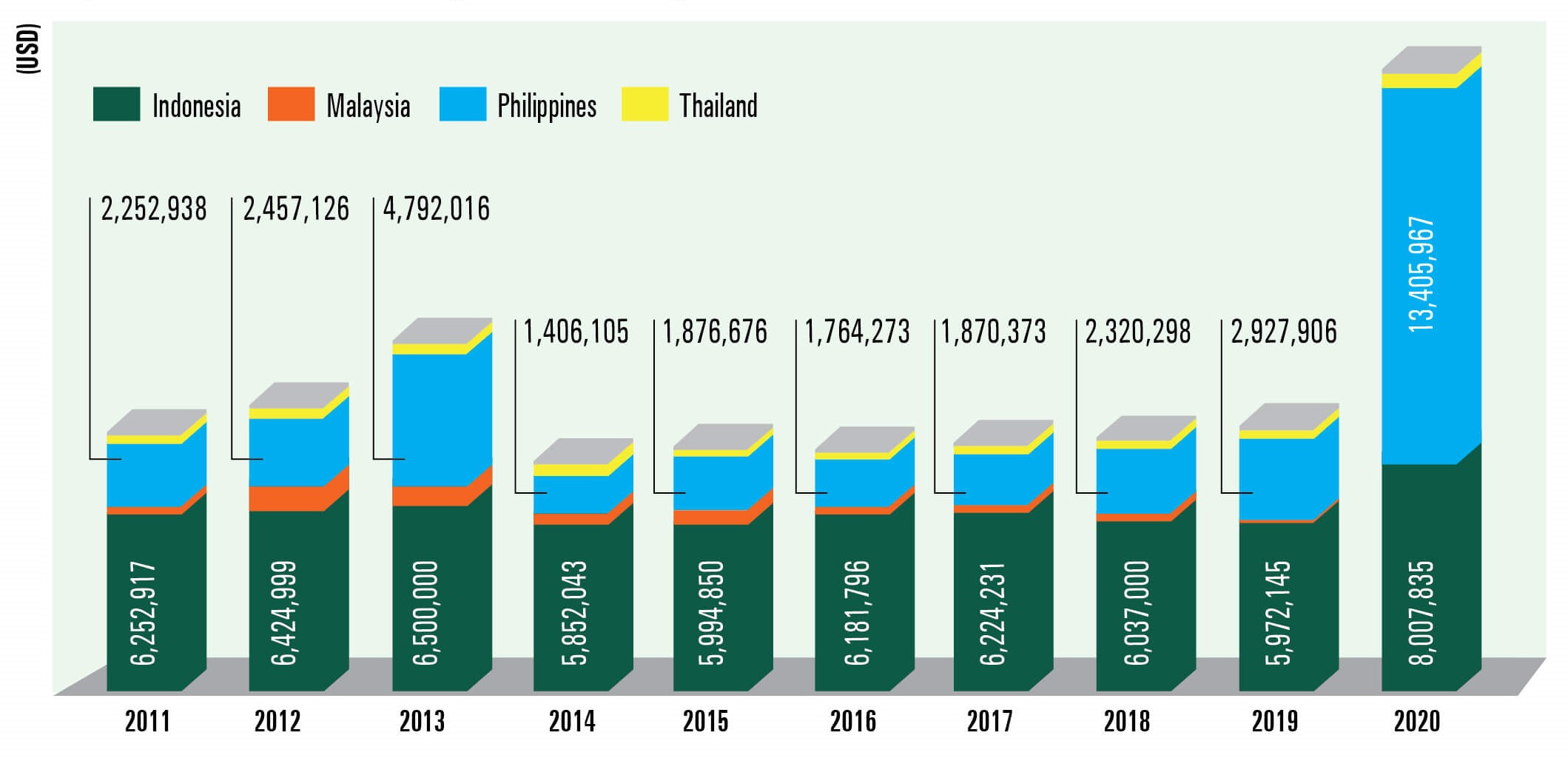

To this end, PMI increased its corporate social responsibility (CSR) investment in the ASEAN region from USD 8,753,391

(in 2017) to USD 21,987,966 (in 2020), with the bulk going to the Philippines (USD 13,405,967) and Indonesia (USD

8,007,835). Both countries are vital tobacco markets, where PMI holds 70.5% and 32.6% of the market respectively.

More than half of the total CSR investment was channelled into Philippines to support activities linked to social welfare,

disaster relief, and others. Generally, fewer organizations benefited from PMI's charitable fund, some of which have been

regular recipients for many years. The amount PMI invested in the Philippines in 2020 is four times more than what it spent

in 2019 (USD 2,927,960).

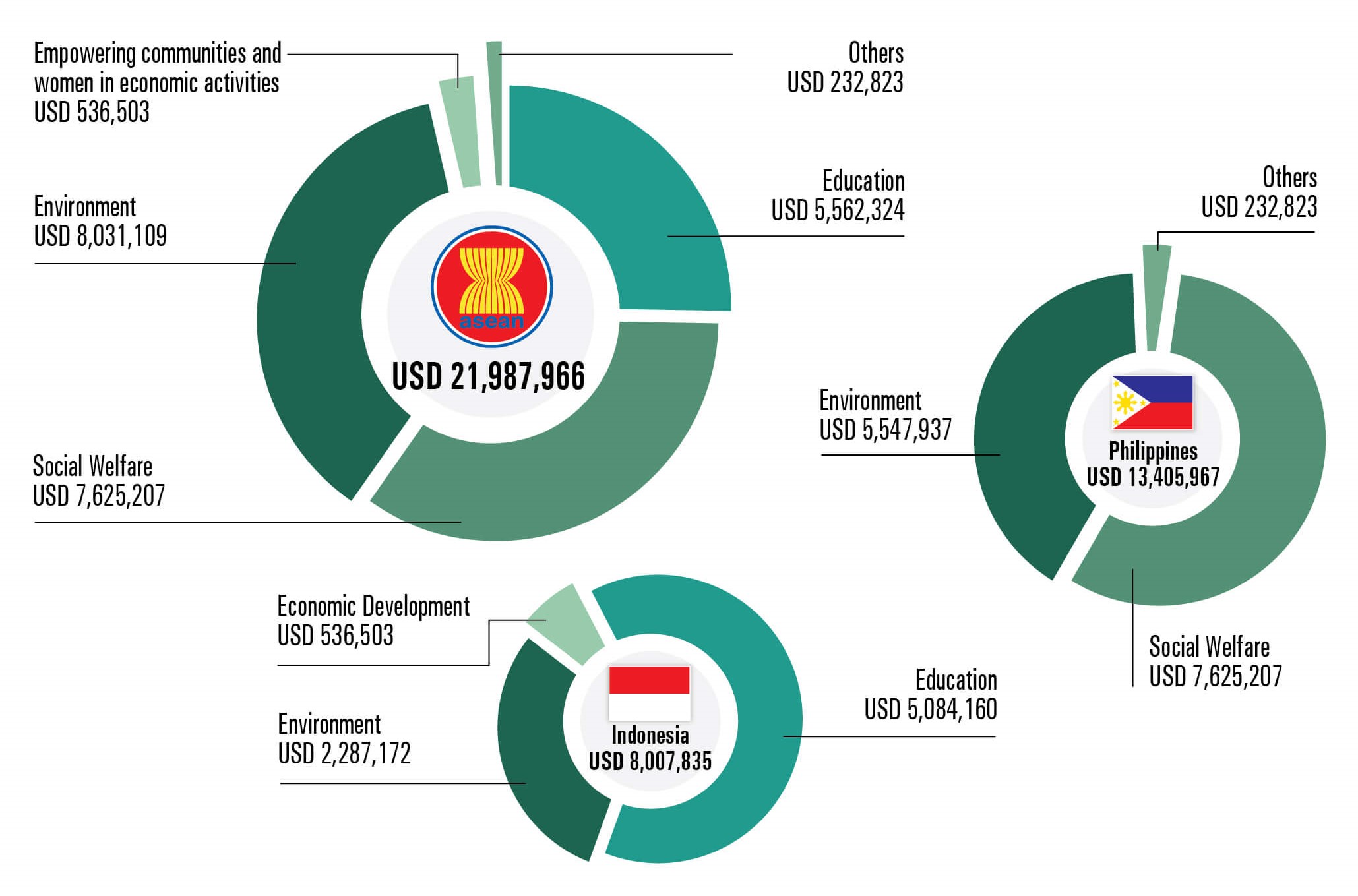

In additional, PMI also provided in-kind contributions of USD 281,123 to organizations in Indonesia, Malaysia and

Singapore in 2020. These include IT and medical equipment, as well as food, water and sanitation.

What transnational tobacco companies (TTCs) spend on CSR activities is paltry compared to the remuneration paid to their

top executives. André Calantzopoulos, CEO of PMI, alone was paid almost more than double PMI's total expenditure on CSR

activities in the ASEAN region in 2019.

Tobacco industry's miniscule CSR spending in ASEAN compared to its profits and remuneration for the CEO

| TTCs | CEO | Remuneration in 2019 (USD) | 2019 profits in global market (USD) | Total expenditure on CSR activities in ASEAN (USD) |

|---|---|---|---|---|

| Philip Morris International (PMI) | André Calantzopoulos | 16.82M | 7.19B | 9,566,715 (2019) |

| British American Tobacco (BAT) | Nicandro Durante Jack Bowles |

11.05M | 7.28B | No data available |

| Imperial Brands | Alison Cooper | 2.84M | 1.29B | No data available |

| Japan Tobacco International (JTI) | Masamichi Terabatake | No data available | 3.20B | 2,609,570 (2016-2019) |

Top 4 ASEAN countries receiving PMI CSR funding (2011 - 2020)

Distribution of PMI CSR activities (2020)

PMI in-kind contribution (2020)

Tobacco industry's CSR during COVID-19 pandemic in ASEAN

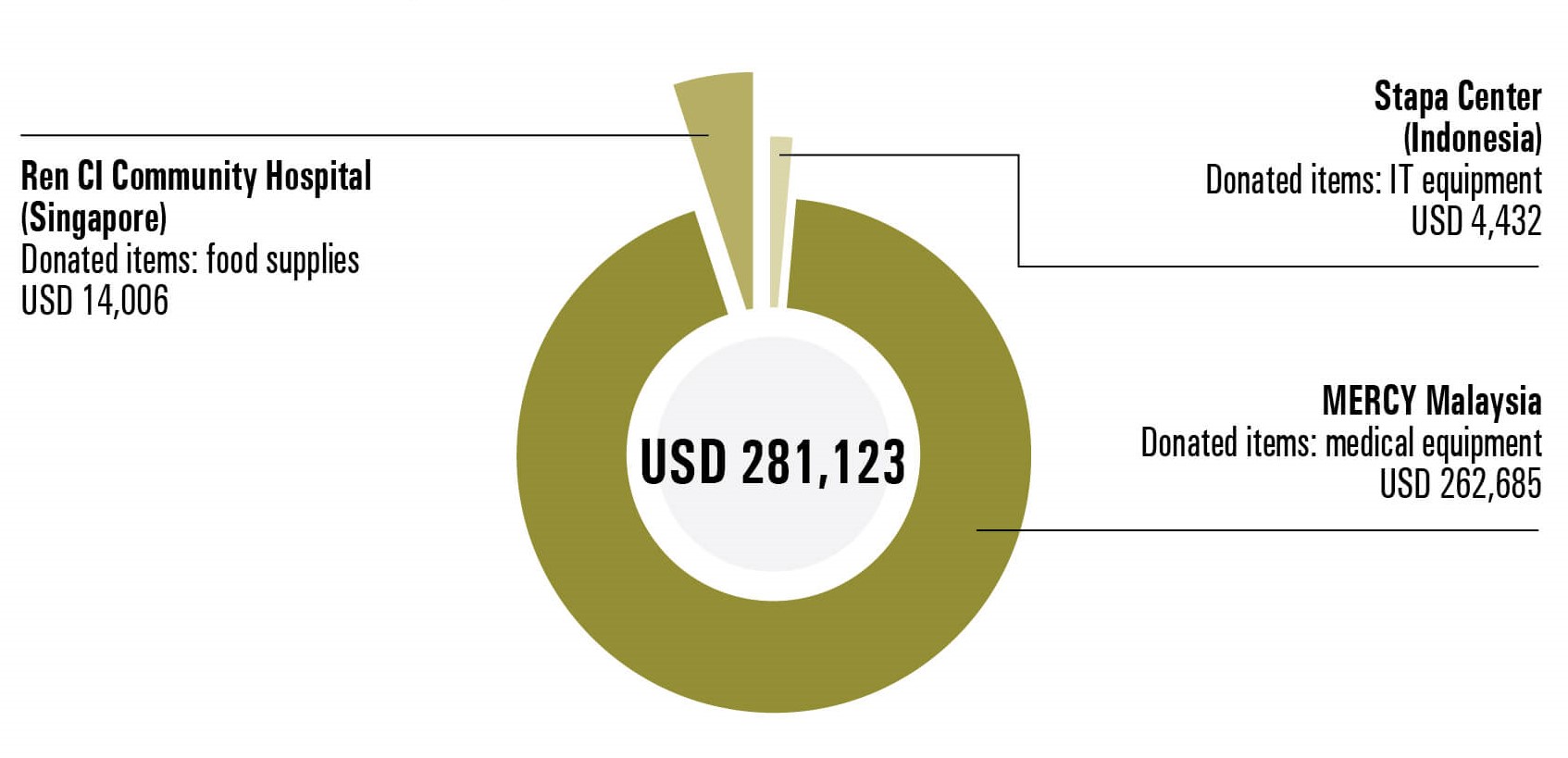

Legal challenges of the tobacco industry to undermine tobacco control in ASEAN

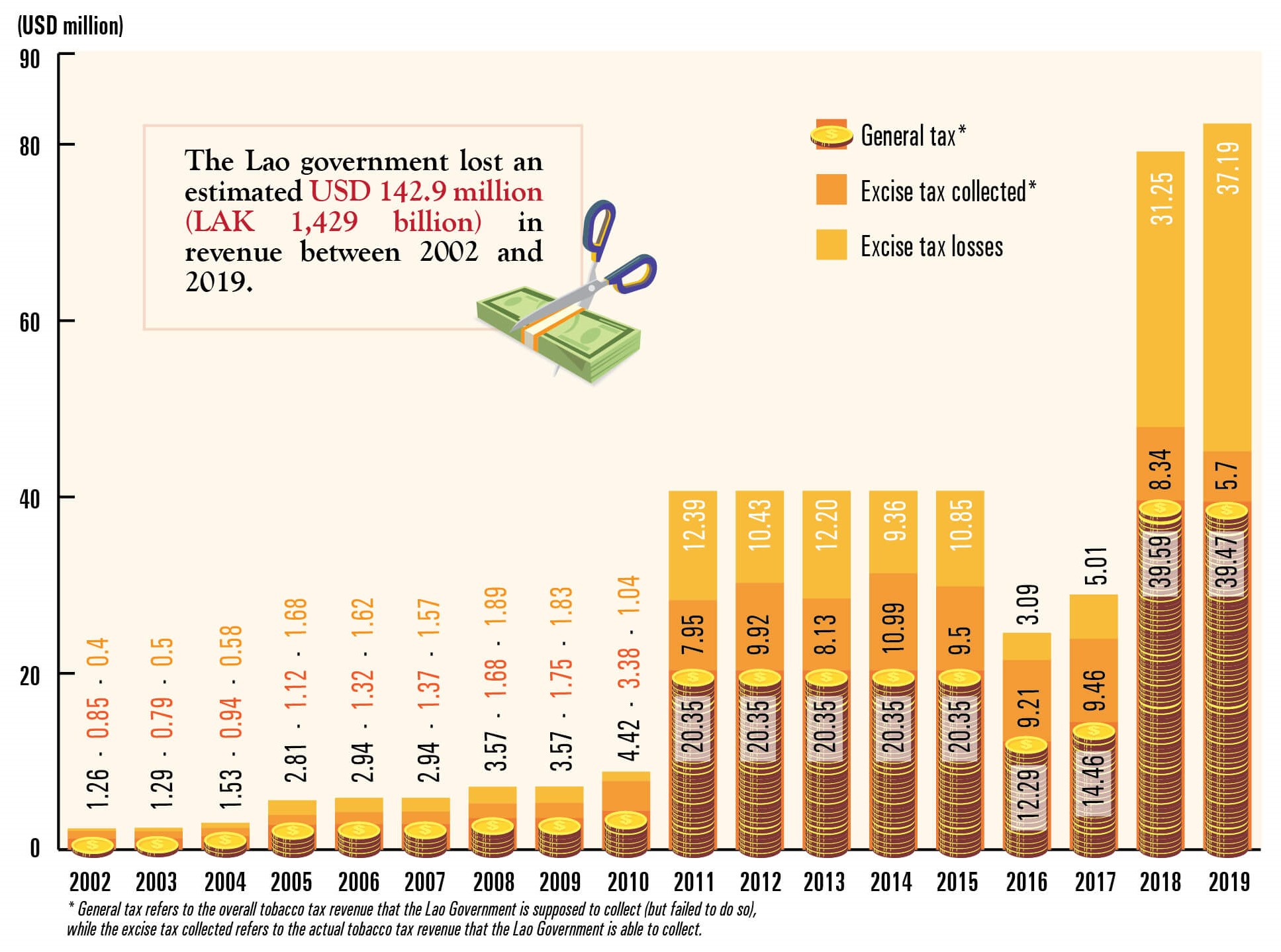

Lao PDR: Tobacco tax revenue losses

The Lao government continues to lose revenues due to its unfair Investment License Agreement (ILA) with the tobacco industry. Signed in 2001, the ILA capped ad valorem tobacco tax rates at 15% to 30% of wholesale price until 2026 (25-year tax break) when the country's tobacco tax rate by law is 50%. If the ILA is not terminated, the Lao government will continue to suffer more revenue losses till 2026.

Tobacco tax revenues and revenue losses in Lao PDR (2002 - 2019)

* General tax refers to the overall tobacco tax revenue that the Lao Government is supposed to collect (but failed to do so), while the excise tax collected refers to the actual tobacco tax revenue that the Lao Government is able to collect.

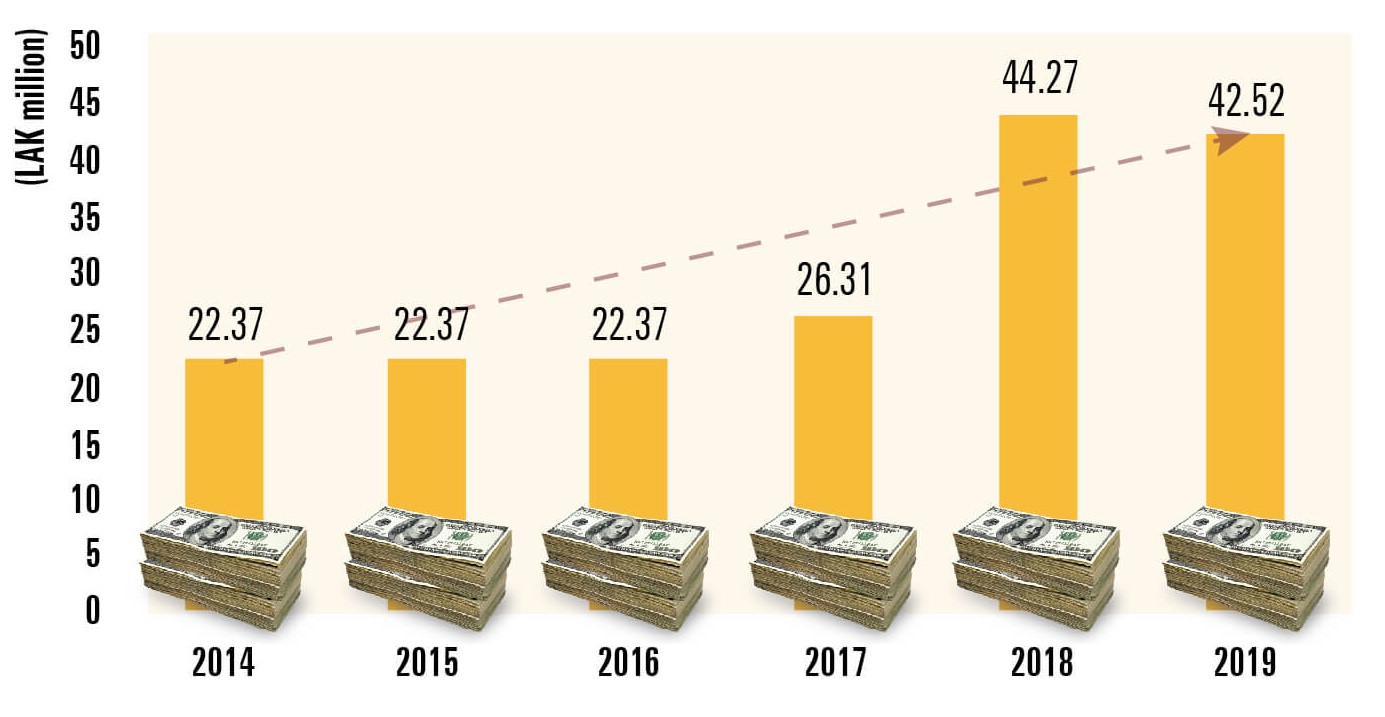

Lao PDR Tobacco Control Fund revenue loss (2014 - 2019)

The Lao government lost an estimated USD 20.33 million (LAK 180.21 billion) between 2014 and 2019 from uncollected revenue (2% of profit tax and LAK 200/ pack surcharge taxes from domestic tobacco companies such as Lao Tobacco Ltd) for Tobacco Control Fund (TCF). A significant loss in revenue collection for TCF to support tobacco control programs and strengthening health care system in the country.

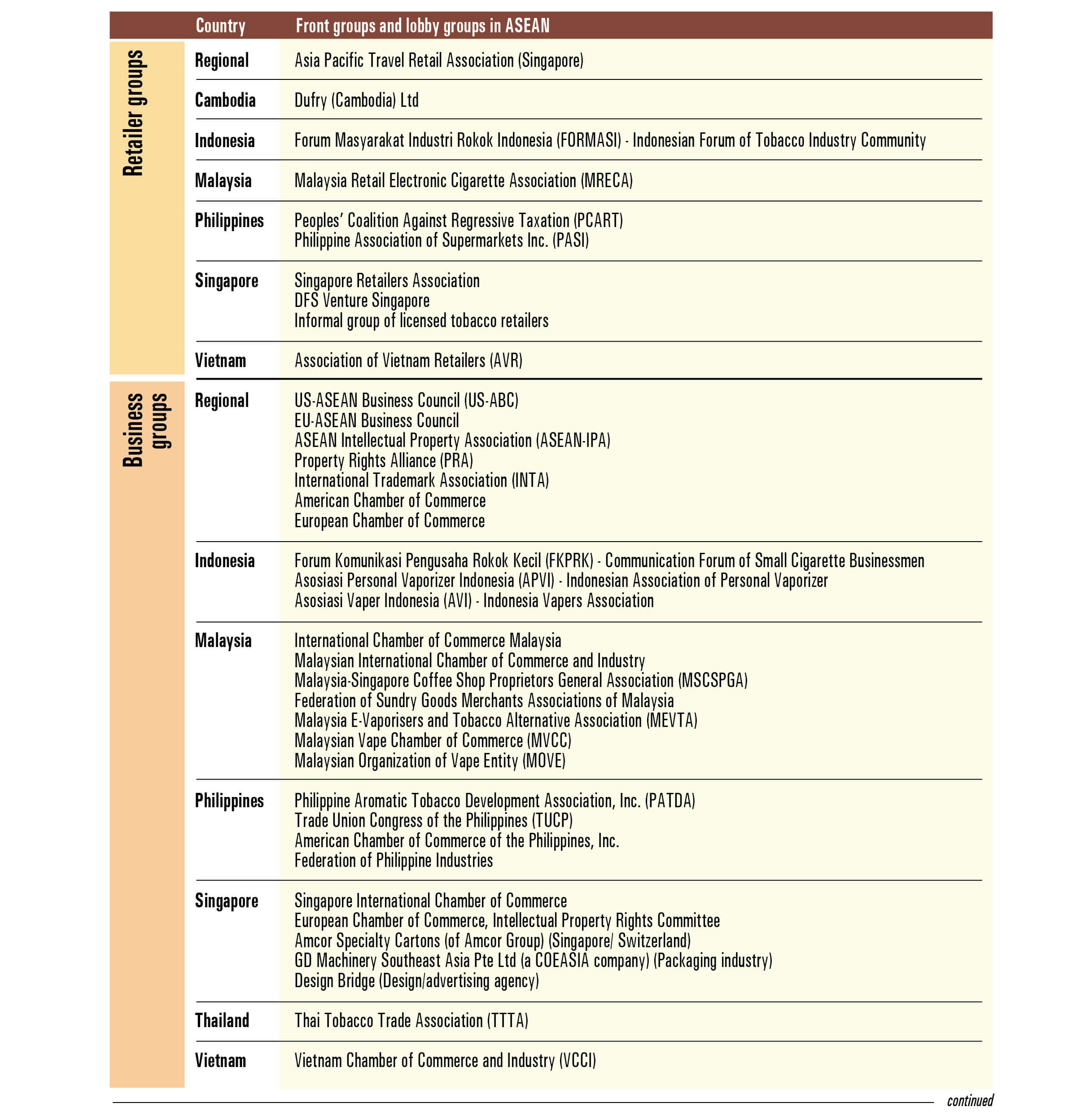

Tobacco Industry front groups and lobby groups to fight tobacco control

The tobacco industry* rallies and funds front groups to fight tobacco control measures at both international and national level. The tobacco industry refers to (a) any tobacco or tobacco product (including electronic smoking devices (ESD)) manufacturer, processor, wholesale distributor, importer , (b) any parent, affiliate, branch, or subsidiary of a tobacco or tobacco product (including ESD) manufacturer, wholesale distributor, importer, retailer, or (c) any individual or entity, such as, but not limited to an interest group, think tank, advocacy organization, lawyer, law firm, scientist, lobbyist, public relations, and/or advertising agency, business, or foundation, that represents or works to promote the interests of the tobacco and nicotine industry. The International Tobacco Growers Association (ITGA) is one such group which mobilizes tobacco growers to interfere in tobacco control policy development in ASEAN countries and fight FCTC implementation particularly Articles 8, 9, 10, 17 and 18. Other front groups include retailers and trade associations, coffee shop associations or research groups, which challenge tobacco control legislation.